Non-Insured Health Benefits Program: First Nations and Inuit Health Branch: Annual Report 2016-2017

On this page

- Section 1: Introduction

- Section 2: Client Population

- Section 3: NIHB Program Benefit Expenditures

- Section 4: NIHB Pharmacy Expenditure and Utilization Data

- Section 5: NIHB Dental Expenditure and Utilization Data

- Section 6: NIHB Medical Transportation Expenditure and Utilization Data

- Section 7: NIHB Vision Benefits, Mental Health Counselling Benefits and Other Health Care Benefits Data

- Section 8: Regional Expenditure Trends 2007/08 to 2016/17

- Section 9: NIHB Program Administration

- Section 10: NIHB Policy and program initiatives

Section 1: Introduction

During 2016/17, the Non-Insured Health Benefits (NIHB) Program of the First Nations and Inuit Health Branch (FNIHB) at the Department of Indigenous Services Canada provided 853,088 eligible First Nations and Inuit clients with access to a range of medically necessary health-related goods and services not otherwise provided through private insurance plans, provincial/territorial health or social programs.

The NIHB Program covers the following medically necessary benefits:

- Prescription and over-the-counter drugs;

- Medical supplies and equipment;

- Dental care;

- Vision care;

- Mental health counselling; and

- Medical transportation to access health services not available locally.

Through the coverage of these benefits, the Department of Indigenous Services Canada supports First Nations and Inuit in reaching an overall health status that is comparable with other Canadians.

The NIHB Program operates according to the following guiding principles:

- All registered First Nations and recognized Inuit normally resident of Canada, and not otherwise covered under a separate agreement with federal or provincial governments or through a separate self-government agreement, are eligible for non-insured health benefits, regardless of location in Canada or income level;

- Benefits will be provided based on professional, medical or dental judgment, consistent with the best practices of health services delivery and evidence-based standards of care;

- There will be national consistency with respect to benefit coverage and access;

- The Program will be managed in a sustainable and cost-effective manner;

- Management processes will be transparent and involve collaboration with First Nations and Inuit organizations; and

- When an NIHB-eligible client is also covered by another public or private health care plan, claims must be submitted to the client's other health care/benefits plan first. NIHB will then coordinate payment with the other plan on eligible benefits.

Now in its twenty-third edition, the 2016/17 NIHB Annual Report provides national and regional data on the NIHB Program client population, expenditures, benefit types and benefit utilization. This Report is published in accordance with the NIHB Program's performance management responsibilities and is intended for the following target audiences:

- First Nations and Inuit organizations and governments at community, regional and national levels;

- Regional and Headquarters managers and staff of Health Canada; and

- Others in government and in non-government organizations with an interest in the provision of health services to First Nations and Inuit communities

British Columbia Tripartite Agreement

The British Columbia Tripartite Framework Agreement on First Nation Health Governance was signed by Canada, the First Nations Health Council (FNHC) and the British Columbia Ministry of Health on October 13, 2011. A key commitment made in the Framework Agreement is the transfer of Federal Health Programs, including Non-Insured Health Benefits (NIHB), from Canada to the First Nations Health Authority (FNHA).

Between July 2nd, 2013 and October 1st, 2013, the FNHA assumed responsibility for the design, planning, management and delivery of the Non-Insured Health Benefits Program to First Nations clients residing in the British Columbia Region. The Department of Indigenous Services Canada has established and implemented measures so that Inuit clients, and First Nations who are in British Columbia temporarily, will continue to access benefits through the federal NIHB Program.

As a transitional measure, The Department of Indigenous Services Canada has continued to provide claims processing and certain adjudication services for the Pharmacy, Dental and MS&E benefits to First Nations clients in British Columbia on behalf of the FNHA. This arrangement will be in place for a term of up to four years. During 2016/17, the NIHB program and the FNHA continued working together in support of ongoing capacity building and to prepare for the full transfer of the NIHB Program in British Columbia following the conclusion of this transition period.

Section 2: Client Population

As of March 31, 2017, there were 853,088 First Nations and Inuit clients eligible to receive benefits under the NIHB Program. The NIHB client population decreased significantly in 2013/14 as a result of the creation of the First Nations Health Authority (FNHA). In a phased approach, between July and October 2013, the FNHA assumed the programs, services, and responsibilities formerly delivered by the Department of Indigenous Services Canada's First Nations and Inuit Health Branch (FNIHB) to First Nation clients residing in British Columbia. Of the 853,088 total eligible clients at the end of the 2016/17 fiscal year, 806,117 (94.5%) were First Nations clients while 46,971 (5.5%) were Inuit clients.

To be an eligible client of the NIHB Program, an individual must be a resident of Canada and have the following status:

- A registered Indian according to the Indian Act; or

- An Inuk recognized by one of the Inuit Land Claim organizations; or

- An infant less than one year of age, whose parent is an eligible client; and

- Currently registered, or eligible for registration, under a provincial or territorial health insurance plan; and

- Is not otherwise covered under a separate agreement (e.g., a self-government agreement) with federal, provincial or territorial governments.

First Nations and Inuit population data are drawn from the Status Verification System (SVS) which is operated by FNIHB. SVS data on First Nations clients are based on information provided by Crown-Indigenous Relations and Northern Affairs Canada (CIRNA). SVS data on Inuit clients are based on information provided by the Governments of the Northwest Territories and Nunavut, and Inuit organizations including the Inuvialuit Regional Corporation, Nunavut Tunngavik Incorporated and the Makivik Corporation.

Historically, the First Nations and Inuit population has a higher growth rate than the Canadian population as a whole. This is primarily because First Nations and Inuit have a higher birth rate compared to the overall Canadian population. In addition, amendments to the Indian Acthave meant that a greater numbers of individuals are able to claim or restore their status as registered Indians. The passage of Bill C-3, the Gender Equity in Indian Registration Act, which came into force on January 31, 2011, has given eligible grandchildren of women who lost status as a result of marrying non-Indian men, entitlement to become registered as an Indian in accordance with the Indian Act. Once registered under the Indian Act, these individuals will be eligible to receive benefits through the NIHB Program. As of March 31, 2017, a total of 29,664 clients had become eligible to receive benefits through the NIHB Program as a result of this legislation.

The creation of the new Qalipu Mi'kmaq First Nations band was announced on September 26, 2011 as a result of a settlement agreement that was negotiated between the Government of Canada and the Federation of Newfoundland Indians (FNI). Through the formation of this band, members of the Qalipu Mi'kmaq became recognized under the Indian Act and eligible for registration. As of March 31, 2017, a total of 24,745 Qalipu clients were registered in the SVS and were eligible to receive benefits through the NIHB Program.

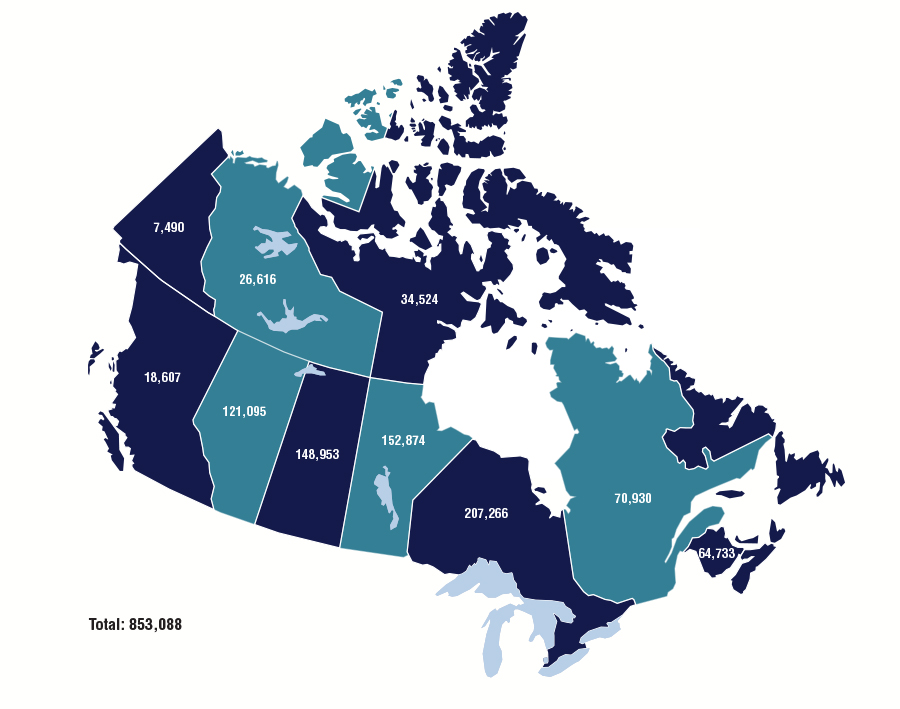

Figure 2.1: Eligible Client Population by Region

March 2017

The total number of NIHB-eligible clients at the end of March 2017 was 853,088, an increase of 1.7% from March 2016.

The Ontario Region had the largest proportion of the eligible population, representing 24.3% of the national total, followed by the Manitoba Region at 17.9% and the Saskatchewan Region at 17.5%.

Note that Figure 2.1 lists population values based on region of band registration, which is not necessarily the client's current region of residence. The majority of British Columbia clients previously covered by the NIHB Program are now covered by the B.C. First Nation Health Authority (FNHA) and are not represented in this chart. The remaining NIHB clients in B.C. are Inuit clients, or clients associated with B.C. bands, but residing in other provinces and territories of Canada (where they are covered under the federal NIHB Program).

Figure 2.1: Eligible Client Population by Region

Total: 853,088

Source: SVS adapted by Business Support, Audit and Negotiations Division

Text Equivalent

| Region | Totals |

|---|---|

| Atlantic | 64,733 |

| Quebec | 70,930 |

| Ontario | 207,266 |

| Manitoba | 152,874 |

| Saskatchewan | 148,953 |

| Alberta | 121,095 |

| British Columbia | 18,607 |

| Yukon | 7,490 |

| N.W.T. | 26,616 |

| Nunavut | 34,524 |

| Total: | 853,088 |

Figure 2.2: Eligible Client Population by Type and Region

March 2016 and March 2017

Of the 853,088 total eligible clients at the end of the 2016/17 fiscal year, 806,117 (94.5%) were First Nations clients while 46,971 (5.5%) were Inuit clients. The number of First Nations clients increased by 1.6% and the number of Inuit clients increased by 2.2%

From March 2016 to March 2017, Alberta had the highest percentage change in total eligible clients with a 2.5% increase, followed by Nunavut and Saskatchewan with increases of 2.4% and 2.0% respectively.

| Region | First Nations | Inuit | Total | % Change | |||

|---|---|---|---|---|---|---|---|

| March/16 | March/17 | March/16 | March/17 | March/16 | March/17 | 2016 to 2017 | |

| Atlantic | 63,362 | 64,362 | 350 | 371 | 63,712 | 64,733 | 1.6% |

| Quebec | 68,384 | 69,494 | 1,374 | 1,436 | 69,758 | 70,930 | 1.7% |

| Ontario | 203,517 | 206,501 | 715 | 765 | 204,232 | 207,266 | 1.5% |

| Manitoba | 150,277 | 152,667 | 198 | 207 | 150,475 | 152,874 | 1.6% |

| Saskatchewan | 145,899 | 148,879 | 69 | 74 | 145,968 | 148,953 | 2.0% |

| Alberta | 117,561 | 120,466 | 609 | 629 | 118,170 | 121,095 | 2.5% |

| B.C. | 18,938 | 18,258 | 339 | 349 | 19,277 | 18,607 | -3.5% |

| Yukon | 7,350 | 7,375 | 106 | 115 | 7,456 | 7,490 | 0.5% |

| N.W.T. | 17,899 | 18,115 | 8,468 | 8,501 | 26,367 | 26,616 | 0.9% |

| Nunavut | 0 | 0 | 33,714 | 34,524 | 33,714 | 34,524 | 2.4% |

| National | 793,187 | 806,117 | 44,733 | 46,971 | 839,129 | 853,088 | 1.7% |

| Source: SVS adapted by Business Support, Audit and Negotiations Division | |||||||

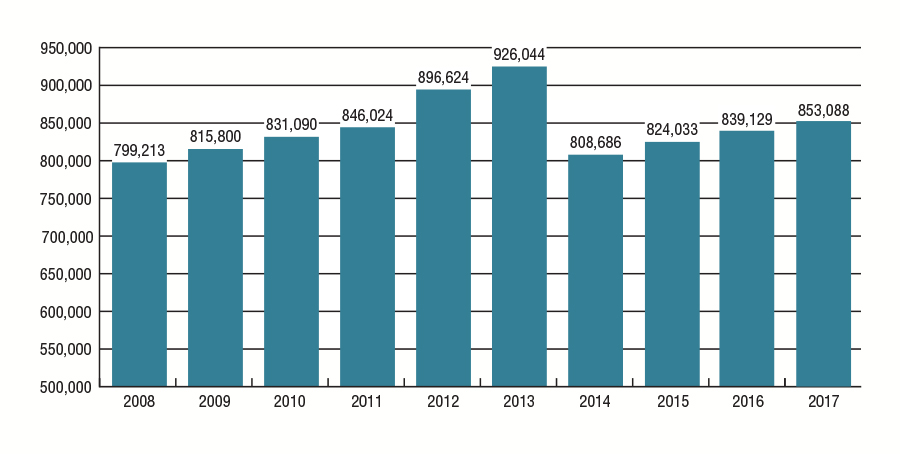

Figure 2.3: Eligible Client Population

Over the past 10 years, the total number of eligible clients in the SVS has increased by 6.7%, from 799,213 in March 2008 to 853,088 in March 2017.

The NIHB Program client population was significantly impacted during this period by amendments to the Indian Act, such as the passage of Bill C-31, Bill C-3, and the creation of the new Qalipu Mi'kmaq Band, which increased the NIHB client population. In contrast, the creation of the First Nations Health Authority (FNHA) in British Columbia and the settlement of First Nations and Inuit self-government agreements, such as those with the Nisga'a Lisims Government and the Nunatsiavut Government, have decreased the total NIHB client population, as these individuals no longer receive benefits through Indigenous Services Canada's NIHB Program. The most notable such change occurred in 2013-14, when approximately 133,430 clients in BC were removed from the NIHB client population when they became eligible to receive non-insured health benefits through the FNHA.

Figure 2.3.1: Eligible Client Population, March 2008 to March 2017

Source: SVS adapted by Business Support, Audit and Negotiations Division

Text Equivalent

| Year | Totals |

|---|---|

| 2008 | 799,213 |

| 2009 | 815,800 |

| 2010 | 831,090 |

| 2011 | 846,024 |

| 2012 | 896,624 |

| 2013 | 926,044 |

| 2014 | 808,686 |

| 2015 | 824,033 |

| 2016 | 839,129 |

| 2017 | 853,088 |

Over the past five years, the NIHB Program's total number of eligible clients decreased by 7.9% from 926,044 in March 2013 to 853,088 in March 2017. Nunavut had the largest increase in eligible clients over this period, with a growth rate of 8.6%. The regions of Quebec, Manitoba, and Ontario followed with growth rates of 7.6%, 5.6% and 5.2% respectively.

| Region | March 2013 | March 2014 | March 2015 | March 2016 | March 2017 |

|---|---|---|---|---|---|

| Atlantic | 62,030 | 62,015 | 62,756 | 63,712 | 64,733 |

| Quebec | 65,944 | 66,819 | 68,274 | 69,758 | 70,930 |

| Ontario | 197,019 | 197,092 | 200,518 | 204,232 | 207,266 |

| Manitoba | 144,748 | 144,416 | 147,932 | 150,475 | 152,874 |

| Saskatchewan | 142,056 | 140,164 | 143,228 | 145,968 | 148,953 |

| Alberta | 115,867 | 113,590 | 115,886 | 118,170 | 121,095 |

| B.C. | 131,782 | 19,628 | 19,283 | 19,277 | 18,607 |

| Yukon | 8,682 | 7,138 | 7,402 | 7,456 | 7,490 |

| N.W.T. | 26,125 | 25,434 | 25,587 | 26,367 | 26,616 |

| Nunavut | 31,791 | 32,390 | 33,167 | 33,714 | 34,524 |

| Total | 926,044 | 808,686 | 824,033 | 839,129 | 853,088 |

| Annual % Change | 3.3% | -12.7% | 1.9% | 1.8% | 1.7% |

| Source: SVS adapted by Business Support, Audit and Negotiations Division | |||||

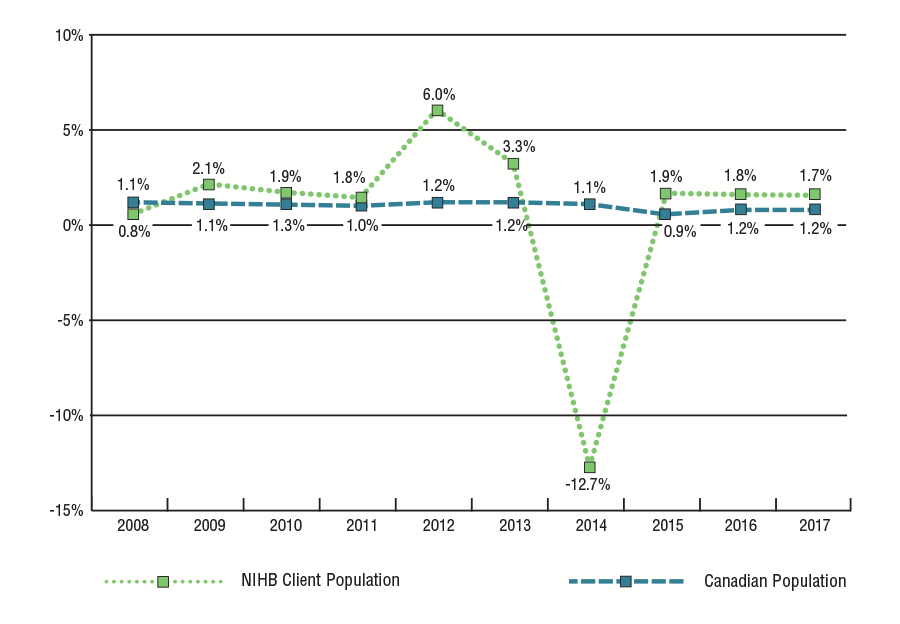

Figure 2.4: Annual Population Growth, Canadian Population and Eligible Client Population

2008 to 2017

From 2008 to 2017, the Canadian population increased by 10.5% while the NIHB eligible First Nations and Inuit client population increased by 6.7%. Prior to the removal of First Nations Health Authority (FNHA) clients, the NIHB ten year eligible population increase was 24.4%, with an average annual growth of 2.4%. Population growth is expected to return to historical rates in future fiscal years as the transition of residents of British Columbia to the FNHA is completed.

The higher than average NIHB Program client population growth rate of 6.0% in 2011-12 and 3.3% in 2012/13 can be attributed to the registration of new Bill C-3 clients as status Indians, and to new Qalipu Mi'kmaq First Nations clients in the Atlantic Region.

Figure 2.4: Annual Population Growth, Canadian Population and Eligible Client Population 2007 to 2016

Source: SVS and Statistics Canada Catalogue No. 91-002-XWE, Quarterly Demographic Statistics, adapted by Business Support, Audit and Negotiations Division

Text Equivalent

| Year | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| NIHB Client Population | 0.8% | 2.1% | 1.9% | 1.8% | 6.0% | 3.3% | -12.7% | 1.9% | 1.8% | 1.7% |

| Canadian Population | 1.1% | 1.1% | 1.3% | 1.0% | 1.2% | 1.2% | 1.1% | 0.9% | 1.2% | 1.2% |

Figure 2.5: Eligible Client Population by Age Group, Gender and Region

March 2017

Of the 853,088 NIHB eligible clients on the SVS as of March 31, 2017, 49.2% were male (419,787) and 50.8% were female (433,301).

The average age of the eligible client population was 33 years of age. By region, this average ranged from a low of 27 years of age in Nunavut to a high of 38 years of age in the Yukon.

The average age of the male and female eligible client population was 32 years and 34 years respectively. The average age for males ranged from a low of 26 years in Nunavut to a high of 36 years in the Quebec and Yukon Region. The average age for females varied from a low of 27 years in Nunavut to a high of 39 years in the Yukon and Quebec Region.

The NIHB eligible First Nations and Inuit client population is relatively young with nearly two-thirds (64.8%) under the age of 40. Of the total population, almost one-third (32.8%) are under the age of 20.

The senior population (clients 65 years of age and over) has been slowly increasing as a proportion of the total NIHB client population. In 2007/08, seniors represented 5.9% of the overall NIHB population. Most recently in 2016/17, seniors accounted for 7.8%. This demographic trend will contribute to cost pressures on the NIHB Program.

| Region | Atlantic | Quebec | Ontario | Manitoba | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Age Group | Male | Female | Total | Male | Female | Total | Male | Female | Total | Male | Female | Total |

| 0-4 | 1,462 | 1,442 | 2,904 | 1,779 | 1,660 | 3,439 | 4,683 | 4,600 | 9,283 | 5,577 | 5,276 | 10,853 |

| 5-9 | 2,265 | 2,193 | 4,458 | 2,639 | 2,529 | 5,168 | 7,438 | 7,204 | 14,642 | 8,357 | 8,193 | 16,550 |

| 10-14 | 2,605 | 2,508 | 5,113 | 2,615 | 2,362 | 4,977 | 7,781 | 7,328 | 15,109 | 7,836 | 7,604 | 15,440 |

| 15-19 | 2,685 | 2,614 | 5,299 | 2,588 | 2,516 | 5,104 | 8,111 | 7,854 | 15,965 | 7,483 | 7,020 | 14,503 |

| 20-24 | 2,893 | 2,862 | 5,755 | 2,982 | 2,877 | 5,859 | 9,028 | 8,786 | 17,814 | 7,613 | 7,379 | 14,992 |

| 25-29 | 2,726 | 2,627 | 5,353 | 2,799 | 2,749 | 5,548 | 8,605 | 8,431 | 17,036 | 6,947 | 6,903 | 13,850 |

| 30-34 | 2,397 | 2,351 | 4,748 | 2,395 | 2,465 | 4,860 | 7,560 | 7,389 | 14,949 | 5,587 | 5,393 | 10,980 |

| 35-39 | 2,186 | 2,202 | 4,388 | 2,248 | 2,208 | 4,456 | 6,814 | 7,086 | 13,900 | 4,782 | 4,586 | 9,368 |

| 40-44 | 2,131 | 2,173 | 4,304 | 2,139 | 2,225 | 4,364 | 6,650 | 6,707 | 13,357 | 4,436 | 4,477 | 8,913 |

| 45-49 | 2,254 | 2,285 | 4,539 | 2,327 | 2,440 | 4,767 | 6,834 | 7,135 | 13,969 | 4,471 | 4,690 | 9,161 |

| 50-54 | 2,134 | 2,269 | 4,403 | 2,388 | 2,703 | 5,091 | 7,076 | 7,493 | 14,569 | 4,072 | 4,194 | 8,266 |

| 55-59 | 1,828 | 2,150 | 3,978 | 2,260 | 2,549 | 4,809 | 6,216 | 7,067 | 13,283 | 3,174 | 3,502 | 6,676 |

| 60-64 | 1,442 | 1,805 | 3,247 | 1,688 | 2,167 | 3,855 | 4,654 | 5,775 | 10,429 | 2,143 | 2,557 | 4,700 |

| 65+ | 2,695 | 3,549 | 6,244 | 3,441 | 5,192 | 8,633 | 9,277 | 13,684 | 22,961 | 3,732 | 4,890 | 8,622 |

| Total | 31,703 | 33,030 | 64,733 | 34,288 | 36,642 | 70,930 | 100,727 | 207,266 | 204,232 | 76,210 | 76,664 | 152,874 |

| Average Age | 35 | 37 | 36 | 36 | 39 | 37 | 35 | 37 | 36 | 29 | 31 | 30 |

| Source: SVS adapted by Business Support, Audit and Negotiations Division | ||||||||||||

| Region | Saskatchewan | Alberta | B.C. | Yukon | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Age Group | Male | Female | Total | Male | Female | Total | Male | Female | Total | Male | Female | Total |

| 0-4 | 4,956 | 4,796 | 9,752 | 4,362 | 4,215 | 8,577 | 900 | 906 | 1,806 | 143 | 124 | 267 |

| 5-9 | 8,145 | 7,844 | 15,989 | 6,866 | 6,572 | 13,438 | 585 | 577 | 1,162 | 268 | 210 | 478 |

| 10-14 | 7,704 | 7,618 | 15,322 | 6,308 | 6,151 | 12,459 | 589 | 579 | 1,168 | 242 | 230 | 472 |

| 15-19 | 7,364 | 7,289 | 14,653 | 5,897 | 5,609 | 11,506 | 664 | 627 | 1,291 | 288 | 266 | 554 |

| 20-24 | 7,589 | 7,412 | 15,001 | 6,258 | 5,770 | 12,028 | 741 | 593 | 1,334 | 309 | 298 | 607 |

| 25-29 | 7,195 | 7,016 | 14,211 | 5,576 | 5,441 | 11,017 | 738 | 665 | 1,403 | 315 | 310 | 625 |

| 30-34 | 5,827 | 5,765 | 11,592 | 4,735 | 4,593 | 9,328 | 733 | 706 | 1,439 | 312 | 278 | 590 |

| 35-39 | 4,898 | 4,775 | 9,673 | 3,836 | 3,973 | 7,809 | 670 | 671 | 1,341 | 273 | 237 | 510 |

| 40-44 | 4,332 | 4,505 | 8,837 | 3,371 | 3,521 | 6,892 | 599 | 609 | 1,208 | 241 | 222 | 463 |

| 45-49 | 4,268 | 4,466 | 8,734 | 3,289 | 3,431 | 6,720 | 628 | 651 | 1,279 | 307 | 251 | 558 |

| 50-54 | 3,670 | 3,983 | 7,653 | 2,915 | 3,262 | 6,177 | 535 | 712 | 1,247 | 327 | 325 | 652 |

| 55-59 | 2,887 | 3,245 | 6,132 | 2,308 | 2,677 | 4,985 | 461 | 665 | 1,126 | 267 | 306 | 573 |

| 60-64 | 1,884 | 2,247 | 4,131 | 1,573 | 2,022 | 3,595 | 306 | 467 | 773 | 164 | 215 | 379 |

| 65+ | 3,053 | 4,220 | 7,273 | 2,676 | 3,888 | 6,564 | 736 | 1,294 | 2,030 | 296 | 466 | 762 |

| Total | 73,722 | 75,181 | 148,953 | 59,970 | 61,125 | 121,095 | 8,885 | 9,722 | 18,607 | 3,752 | 3,738 | 7,490 |

| Average Age | 29 | 30 | 29 | 29 | 30 | 30 | 33 | 37 | 35 | 36 | 39 | 38 |

| Source: SVS adapted by Business Support, Audit and Negotiations Division | ||||||||||||

| Region | N.W.T. | Nunavut | TOTAL | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Age Group | Male | Female | Total | Male | Female | Total | Male | Female | Total |

| 0-4 | 654 | 641 | 1,295 | 2,044 | 1,909 | 3,953 | 26,560 | 25,569 | 52,129 |

| 5-9 | 1,036 | 966 | 2,002 | 2,071 | 2,038 | 4,109 | 39,670 | 38,326 | 77,996 |

| 10-14 | 988 | 1,001 | 1,989 | 1,915 | 1,787 | 3,702 | 38,583 | 37,168 | 75,751 |

| 15-19 | 989 | 983 | 1,972 | 1,742 | 1,645 | 3,387 | 37,811 | 36,423 | 74,234 |

| 20-24 | 1,384 | 1,329 | 2,713 | 1,626 | 1,578 | 3,204 | 40,423 | 38,884 | 79,307 |

| 25-29 | 1,356 | 1,368 | 2,724 | 1,593 | 1,540 | 3,133 | 37,850 | 37,050 | 74,900 |

| 30-34 | 1,111 | 1,016 | 2,127 | 1,212 | 1,225 | 2,437 | 31,869 | 31,181 | 63,050 |

| 35-39 | 923 | 922 | 1,845 | 998 | 1,011 | 2,009 | 27,628 | 27,671 | 55,299 |

| 40-44 | 785 | 851 | 1,636 | 871 | 881 | 1,752 | 25,555 | 26,171 | 51,726 |

| 45-49 | 946 | 993 | 1,939 | 927 | 944 | 1,871 | 26,251 | 27,286 | 53,537 |

| 50-54 | 825 | 910 | 1,735 | 771 | 809 | 1,580 | 24,713 | 26,660 | 51,373 |

| 55-59 | 653 | 779 | 1,432 | 539 | 557 | 1,096 | 20,593 | 23,497 | 44,090 |

| 60-64 | 420 | 571 | 991 | 370 | 377 | 747 | 14,644 | 18,203 | 32,847 |

| 65+ | 992 | 1,224 | 2,216 | 739 | 805 | 1,544 | 27,637 | 39,212 | 66,849 |

| Total | 13,062 | 13,554 | 26,616 | 17,418 | 17,106 | 34,524 | 419,787 | 433,301 | 853,088 |

| Average Age | 33 | 35 | 34 | 26 | 27 | 27 | 32 | 34 | 33 |

| Source: SVS adapted by Business Support, Audit and Negotiations Division | |||||||||

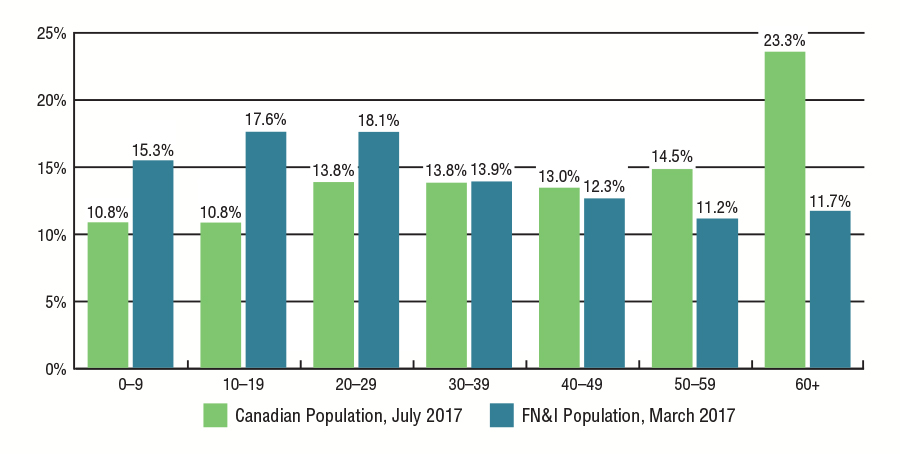

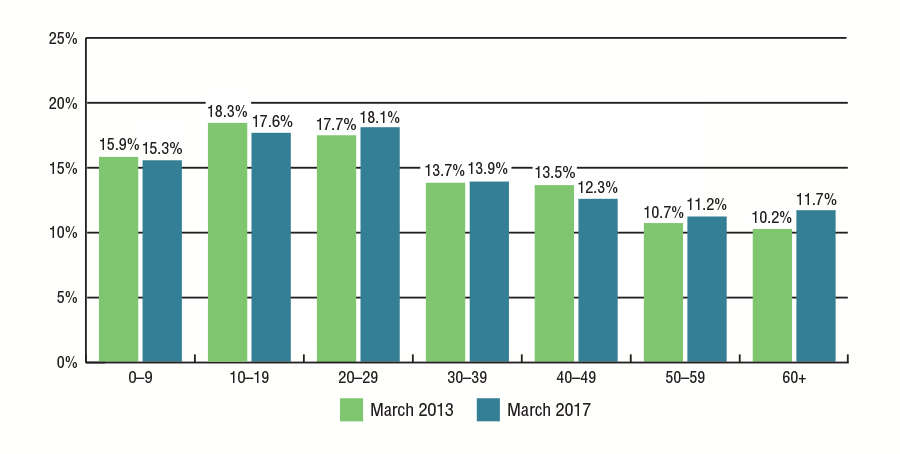

Figure 2.6: Population Analysis by Age Group

The overall First Nations and Inuit client population is relatively young compared to the general Canadian population. The share of the NIHB client population under 20 years of age was 32.8% compared to 21.6% of the same age group in the Canadian population. The average age of First Nations and Inuit clients is 33 compared to 41 years of age for the Canadian population.

Figure 2.6.1: Proportion of Canadian Population and of the First Nations and Inuit (FN&I) Client Population by Age Group

Source: SVS and Statistics Canada CANSIM table 051-0001, Population by Age and Sex Group, adapted by Business Support, Audit and Negotiations Division

Text Equivalent

| Age Group | Canadian Population, July 2017 | FN&I Population, March 2017 |

|---|---|---|

| 0-9 | 10.8% | 15.3% |

| 10-19 | 10.8% | 17.6% |

| 20-29 | 13.8% | 18.1% |

| 30-39 | 13.8% | 13.9% |

| 40-49 | 13.0% | 12.3% |

| 50-59 | 14.5% | 11.2% |

| 60+ | 23.3% | 11.7% |

A comparison of March 2013 to March 2017 eligible client population shows an aging population. The client population 40 and above, as a proportional share of the overall client population, increased from 34.4% in 2013 to 35.2% in 2017.

As the First Nations and Inuit client population ages, the costs associated with delivering Non-Insured Health Benefits, particularly pharmacy benefits, to this client population are expected to increase significantly.

Figure 2.6.2: Proportion of Eligible First Nations and Inuit Client Population by Age Group

Source: SVS adapted by Business Support, Audit and Negotiations Division

Text Equivalent

| Age Group | March 2013 | March 2017 |

|---|---|---|

| 0-9 | 15.9% | 15.3% |

| 10-19 | 18.3% | 17.6% |

| 20-29 | 7.7% | 18.1% |

| 30-39 | 13.7% | 13.9% |

| 40-49 | 13.5% | 12.3% |

| 50-59 | 10.7% | 11.2% |

| 60+ | 10.2% | 11.7% |

Section 3: NIHB Program Benefit Expenditures

Figure 3.1: NIHB Program Sustainability

2016/17

Cost and service pressures on the Canadian health system have been linked to factors such as an aging population and the increased demand for and utilization of health goods, particularly pharmaceuticals, and services. In addition to these factors, NIHB Program expenditures are driven by the number of eligible clients and their medical needs. The NIHB client population is growing at approximately two times the Canadian population growth rate. A significant proportion of NIHB clients live in small and remote communities, and require medical transportation to access health services that are not available locally.

| Client Base | Market Forces | Clinical Evidence |

|---|---|---|

|

|

|

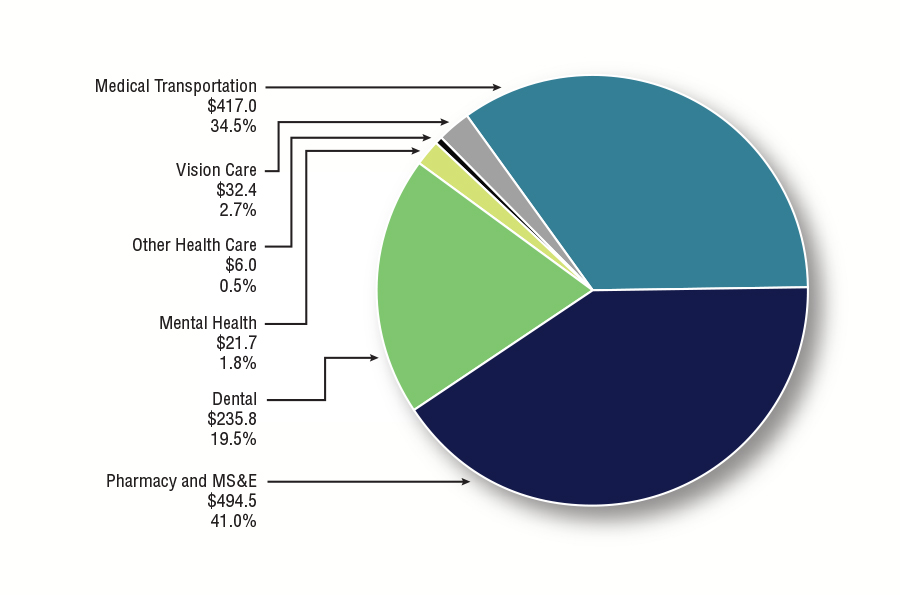

Figure 3.2: NIHB Expenditures by Benefit ($ Millions)

2016/17

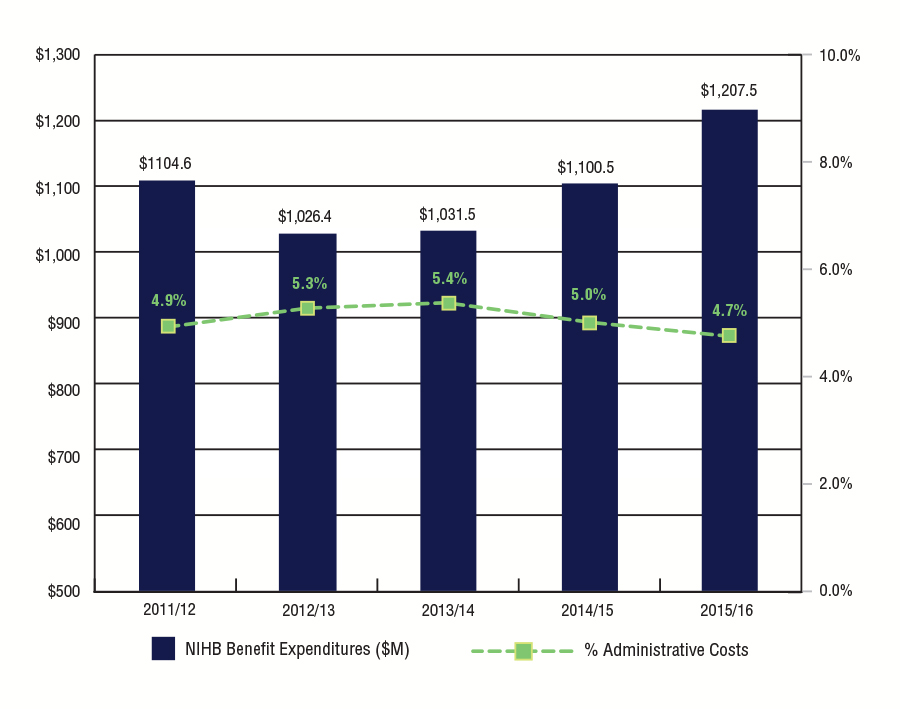

In 2016/17, total NIHB Program benefit expenditures were $1,207.5 million. This represents an increase of 9.7% over NIHB expenditures of $1,100.5 million in 2015/16.

Of the 2016/17 total, Pharmacy costs (including medical supplies and equipment) represented the largest proportion at $494.5 million (41.0%), followed by Medical Transportation costs at $417.0 million (34.5%) and Dental costs at $235.8 million (19.5%).

Figure 3.2: NIHB Expenditures by Benefit ($ Millions) 2016/17

Text Equivalent

| Benefit | Expenditure in millions | proportion of total expenditure |

|---|---|---|

| Pharmacy and MS&E | $494.5 | 41.0% |

| Dental | $235.8 | 19.5% |

| Vision Care | $32.4 | 2.7% |

| Mental Health | $21.7 | 1.8% |

| Other Health Care | $6.0 | 0.5% |

| Medical Transportation | $417.0 | 34.5% |

| Total NIHB Program Benefit Expenditures | $1,207.5M | 100% |

* Not reflected in the $1,207.5 million in NIHB expenditures is approximately $37.2 million in administration costs including Program staff and other headquarters and regional costs. More detail is provided in Figure 11.1.

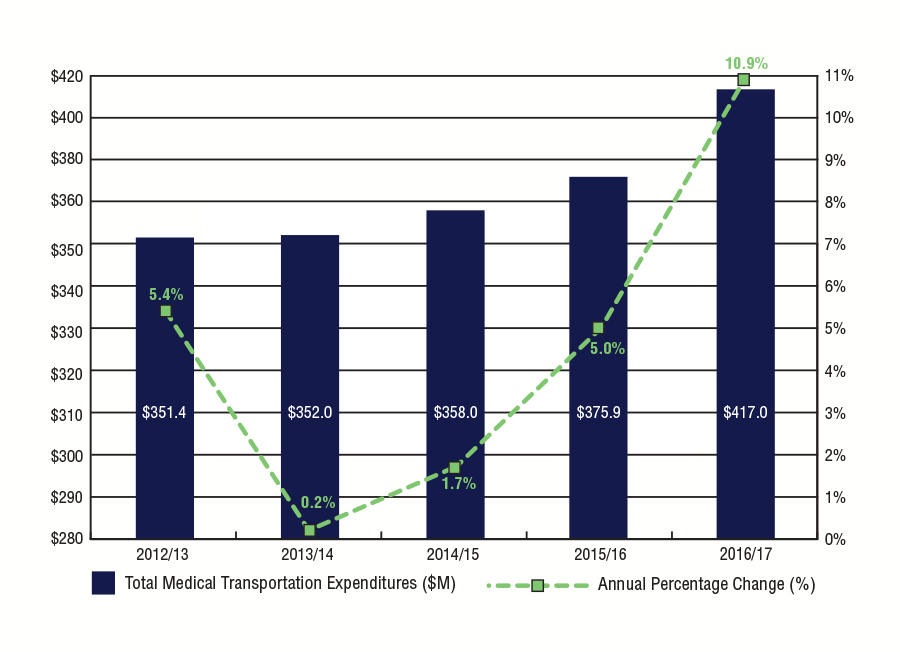

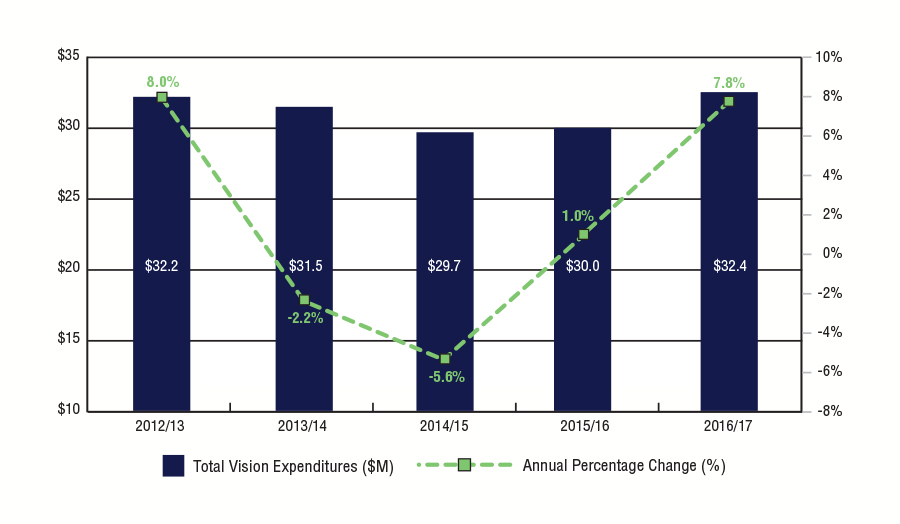

Figure 3.3: NIHB Expenditures and Growth by Benefit

2016/17

NIHB Program benefit expenditures increased by 9.7%, or $106.9 million overall from 2015/16. All NIHB benefit areas had an increase in expenditures over the previous fiscal year. The highest net increase in expenditures over fiscal year 2015/16 was in the NIHB Medical Transportation benefit at $41.1 million, followed by NIHB Pharmacy and MS&E benefits with an increase of $38.1 million and the NIHB Dental benefit which increased by $18.7 million. Factors affecting benefit expenditure growth are discussed in subsequent sections of this report.

| Benefit | Total Expenditures ($ 000's) 2015/16 | Total Expenditures ($ 000's) 2016/17 | % Change From 2015/16 |

|---|---|---|---|

| Medical Transportation | $375,904 | $417,035 | 10.9% |

| Pharmacy and MS&E | $456,430 | $494,520 | 8.3% |

| Dental | $217,109 | $235,831 | 8.6% |

| Vision Care | $30,017 | $32,370 | 7.8% |

| Mental Health | $16,193 | $21,728 | 34.2% |

| Other | $4,858 | $5,974 | 23.0% |

| Total Expenditures | $1,100,512 | $1,207,458 | 9.7% |

| Source: FIRMS adapted by Business Support, Audit and Negotiations Division | |||

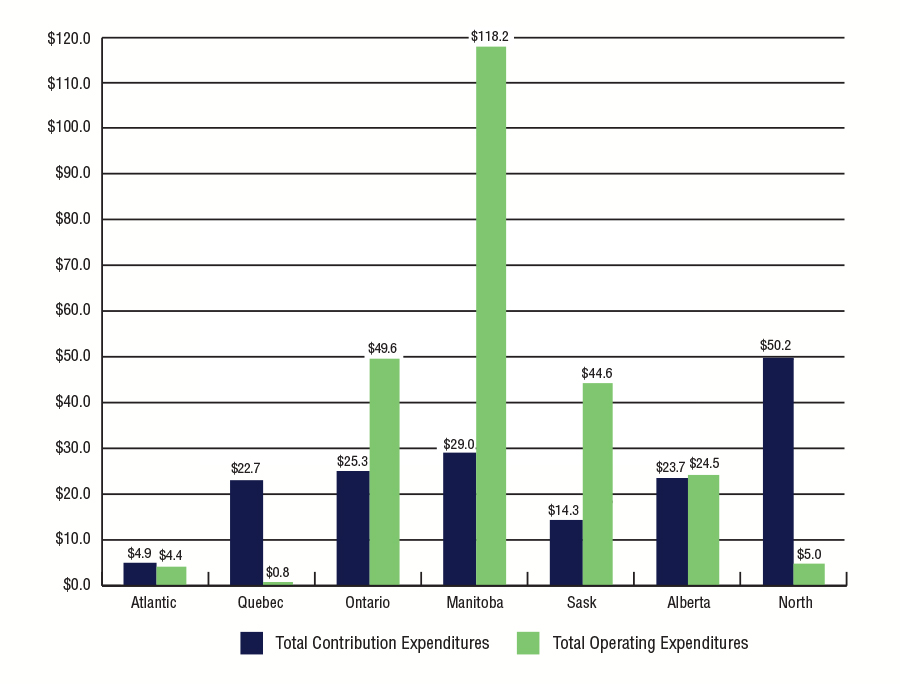

Figure 3.4: NIHB Expenditures by Benefit and Region ($ 000's)

2016/17

The Manitoba Region accounted for the highest proportion of total expenditures at $292.0 million, or 24.2% of the national total, followed by the Ontario Region at $231.7 million (19.2%), and the Saskatchewan Region at $220.4 million (18.2%). In comparison, the lowest expenditure was in the Atlantic Region at $55.1 million (4.6%).

Headquarters expenditures by benefit type represent costs paid for claims processing services. Headquarters expenditures in the 'Other Health Care' category include funding arrangements with the FNHA for Bill C-3 and Qalipu clients and for payment of Inuit premiums in British Columbia, as well as with national client stakeholder organizations (Assembly of First Nations and Inuit Tapiriit Kanatami), and regional Indigenous organizations. These expenditures account for 2.0% ($23.7 million) of NIHB expenditures, and do not include the $16.3 million in Headquarters administrative costs outlined in Figure 11.1.

| Region | Medical Transportation | Pharmacy | Dental | Vision Care | Mental Health | Other Health Care | TOTAL |

|---|---|---|---|---|---|---|---|

| Atlantic | $9,277 | $31,899 | $9,593 | $3,502 | $601 | $207 | $55,079 |

| Quebec | $23,501 | $47,444 | $17,569 | $1,762 | $1,292 | $263 | $91,831 |

| Ontario | $74,890 | $94,101 | $52,105 | $6,223 | $4,091 | $254 | $231,663 |

| Manitoba | $147,167 | $94,757 | $39,986 | $4,204 | $5,635 | $240 | $291,989 |

| Saskatchewan | $58,902 | $104,082 | $47,321 | $6,533 | $3,304 | $210 | $220,352 |

| Alberta | $48,157 | $77,265 | $44,315 | $6,928 | $6,444 | $0 | $183,108 |

| North | $55,125 | $28,488 | $21,966 | $3,217 | $362 | $260 | $109,417 |

| Headquarters | $16 | $16,302 | $2,877 | $0 | $0 | $4,540 | $23,735 |

| Total | $417,035 | $235,831 | 100% | $32,370 | $21,728 | $5,974 | $1,207,458 |

| Source: FIRMS adapted by by Business Support, Audit and Negotiations Division | |||||||

Figure 3.5: Proportion of NIHB Expenditures by Region

2016/17

In 2016/17, the Manitoba Region had the highest proportion of total NIHB expenditures (24.2%) and accounted for 35.3% of total NIHB Medical Transportation expenditures. This can be attributed to the large number of First Nations clients living in remote or fly-in only northern communities in the Manitoba Region.

The Saskatchewan Region accounted for the highest proportion of NIHB Pharmacy expenditures at 21.0%, followed closely by Manitoba and Ontario at 19.2% and 19.0% respectively.

The Ontario Region, which accounted for 19.2% of total NIHB expenditures in 2016/17, recorded the highest proportion of total NIHB Dental expenditures at 22.0%. This region also accounted for the highest proportion of the total NIHB population at 24.3%.

The proportion of NIHB Vision Care expenditures ranged from highs of 21.4% in the Alberta Region, 20.2% in the Saskatchewan Region and 19.2% in the Ontario Region to a low of 5.4 % in Quebec.

The Alberta Region (29.7%) and the Manitoba Region (25.9%) combined accounted for over one-half of total NIHB Mental Health expenditures in 2016/17.

| Region | Medical Transportation | Pharmacy | Dental | Vision Care | Mental Health | Other Health Care | Proportion of NIHB Expenditure | Proportion of NIHB Population |

|---|---|---|---|---|---|---|---|---|

| Atlantic | 2.2% | 6.5% | 4.1% | 10.8% | 2.8% | 3.5% | 4.6% | 7.6% |

| Quebec | 5.6% | 9.6% | 7.4% | 5.4% | 5.9% | 4.4% | 7.6% | 8.3% |

| Ontario | 18.0% | 19.0% | 22.0% | 19.2% | 18.8% | 4.3% | 19.2% | 24.3% |

| Manitoba | 35.3% | 19.2% | 16.9% | 13.0% | 25.9% | 4.0% | 24.2% | 17.9% |

| Saskatchewan | 14.1% | 21.0% | 20.0% | 20.2% | 15.2% | 3.5% | 18.2% | 17.5% |

| Alberta | 11.5% | 15.6% | 18.8% | 21.4% | 29.7% | 0.0% | 15.2% | 14.2% |

| North | 13.2% | 5.8% | 9.5% | 9.9% | 1.7% | 4.4% | 9.1% | 8.0% |

| Headquarters | 0.0% | 3.3% | 1.2% | 0.0% | 0.0% | 76.0% | 2.0% | 0.0% |

| Total | 100% | 100% | 100% | 100% | 100% | 100% | 100% | 100% |

| Source: FIRMS and SVS adapted by by Business Support, Audit and Negotiations Division | ||||||||

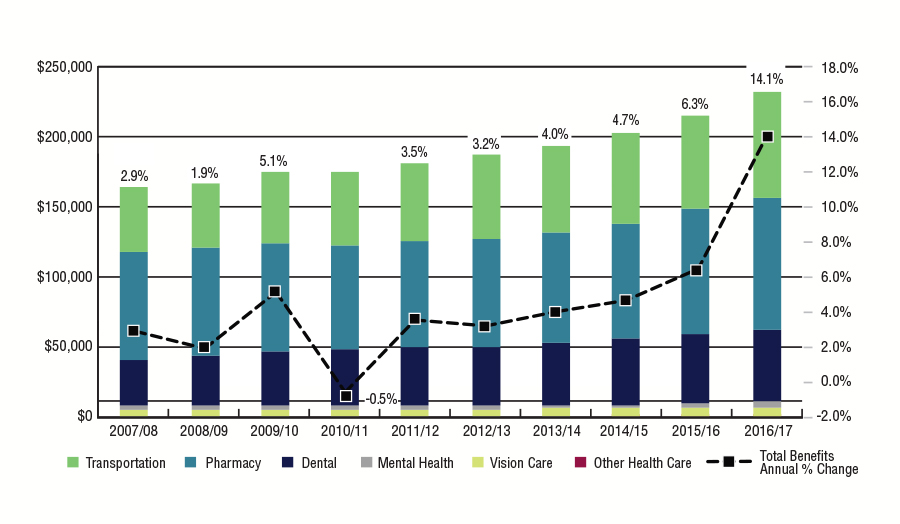

Figure 3.6: Proportion of NIHB Regional Expenditures by Benefit

2016/17

At the national level, approximately three-quarters (75.5%) of total Program expenditures occurred in two benefit areas: pharmacy (41.0%) and medical transportation (34.5%). Dental expenditures accounted for one-fifth (19.5%) of total NIHB expenditures.

Medical Transportation expenditures accounted for half of benefit expenditures in the Manitoba and Northern Regions (50.1% and 50.4%, respectively). In the Atlantic Region, 16.9% of benefit expenditures were spent on medical transportation.

The proportion of dental expenditures ranged from 13.7% in the Manitoba Region to 24.2% in Alberta Region.

In the Atlantic Region, 57.9% of total expenditures were spent on pharmacy benefits. Pharmacy costs represented the highest percentage of total expenditures in all regions except in the Northern Region and in Manitoba, where transportation accounted for the largest share of costs.

| Region | Medical Transportation | Pharmacy | Dental | Vision Care | Mental Health | Other Health Care | Total |

|---|---|---|---|---|---|---|---|

| Atlantic | 16.8% | 57.9% | 17.4% | 6.4% | 1.1% | 0.4% | 100% |

| Quebec | 25.6% | 51.7% | 19.1% | 1.9% | 1.4% | 0.3% | 100% |

| Ontario | 32.3% | 40.6% | 22.5% | 2.7% | 1.8% | 0.1% | 100% |

| Manitoba | 50.4% | 32.5% | 13.7% | 1.4% | 1.9% | 0.1% | 100% |

| Saskatchewan | 26.7% | 47.2% | 21.5% | 3.0% | 1.5% | 0.1% | 100% |

| Alberta | 26.3% | 42.2% | 24.2% | 3.8% | 3.5% | 0.0% | 100% |

| North | 50.4% | 26.0% | 20.1% | 2.9% | 0.3% | 0.2% | 100% |

| Headquarters | 0.1% | 68.7% | 12.1% | 0.0% | 0.0% | 19.1% | 100% |

| National | 34.5% | 41.0% | 19.5% | 2.7% | 1.8% | 0.5% | 100% |

| Source: FIRMS and SVS adapted by by Business Support, Audit and Negotiations Division | |||||||

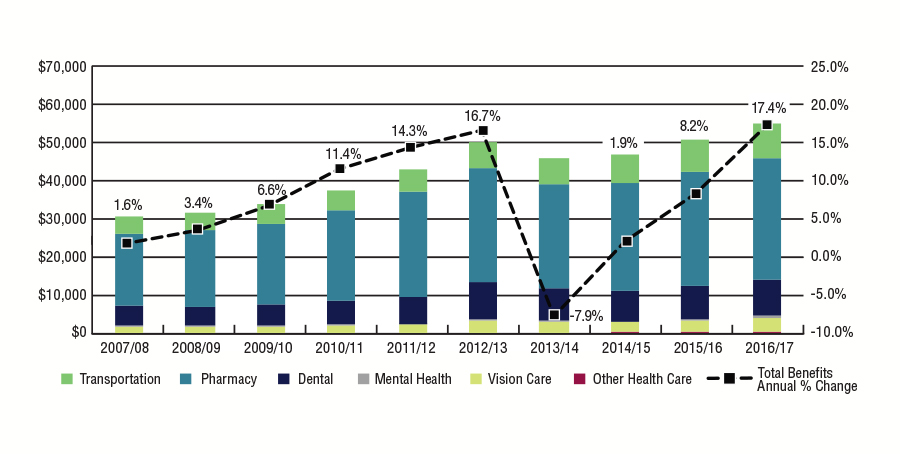

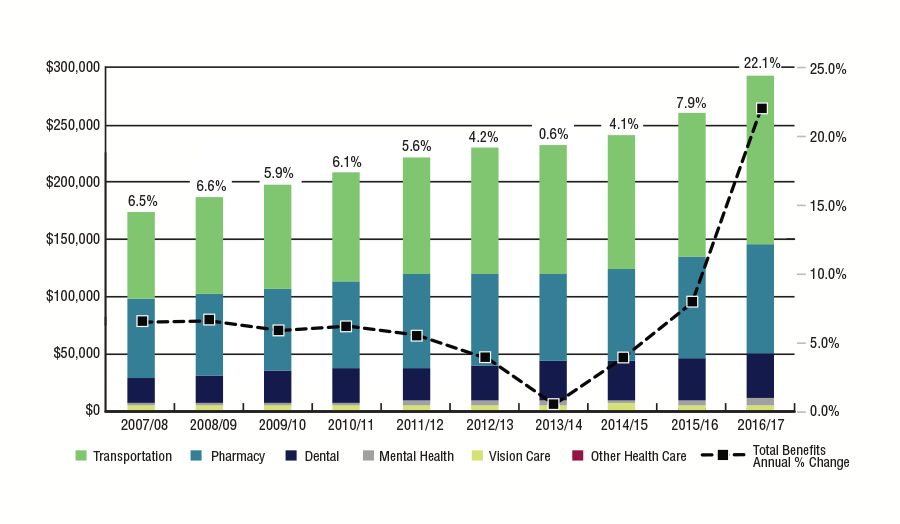

Figure 3.7: NIHB Annual Expenditures by Benefit ($ 000's)

2007/08 to 2016/17

In 2016/17, NIHB Program expenditures totalled $1,207.5 million, an increase of 9.7% from $1,100.5 million in 2015/16. Since 2007/08, total expenditures have grown by 34.4%. The annualized rate of growth over this period was 3.5%. There has been wide variation in growth rates between 2007/08 and 2016/17, with a low of -7.1% in 2013/14Footnote 1 to a high of 9.7% in 2016/17.

Fluctuations in NIHB expenditure growth rates are impacted by a number of factors. Changes in the eligible client population have a direct impact on growth. Notable examples include the transfer of responsibility for First Nations clients residing in BC to the FNHA in 2013/14, the creation of the Qalipu Mi'kmaq Band in 2011, and court decisions such as Bill C-3 that have resulted newly eligible clients.

NIHB expenditure growth rates are also impacted by the introduction of new therapies and generic drugs to the market, changes to provincial pricing policies, and economic inflationary pressures. In addition, rates of expenditure growth are impacted by new self-government initiatives, policy changes to improve access to benefits or promote sustainability, and changes in service delivery models within the Program, within the federal government, and between the provinces and territories.

NIHB Annual Expenditures ($ Millions) and Percentage Change

Source: FIRMS and SVS adapted by by Business Support, Audit and Negotiations Division

Text Equivalent

| BENEFIT | 2007/08 | 2008/09 | 2009/10 | 2010/11 | 2011/12 | 2012/13 | 2013/14 | 2014/15 | 2015/16 | 2016/17 |

|---|---|---|---|---|---|---|---|---|---|---|

| Annual Expenditures ($ Millions) | $898 | $940 | $989 | $1,028 | $1,074 | $1,105 | $1,1026 | $1,031 | $1,101 | $1,207 |

| Percentage Change | 4.9% | 4.7% | 5.2% | 3.9% | 4.5% | 2.8% | -7.1% | 0.5% | 6.7% | 9.7% |

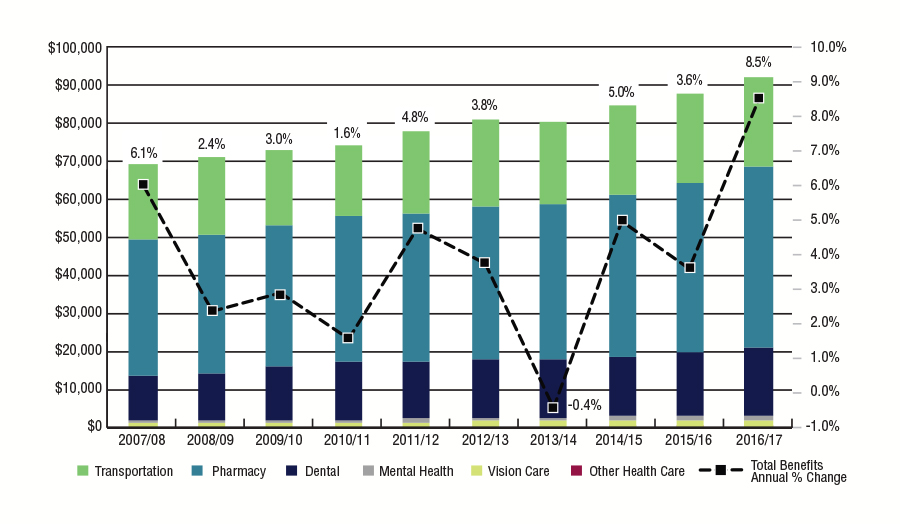

Figure 3.8: NIHB Annual Expenditures by Benefit ($ 000's)

2007/08 to 2016/17

In the period from 2007/08 to 2016/17, expenditures for NIHB Medical Transportation and Dental benefits have grown more than other benefit areas. NIHB Medical Transportation expenditures grew by 59.0% from $262.3 million in 2007/08 to $417.0 million in 2016/17. NIHB Dental expenditures rose by 42.4% from $165.6 million in 2007/08 to $235.8 million in 2015/16.

Over the same period, NIHB Pharmacy expenditures increased by 22.6% and NIHB Vision expenditures had an increase of 26.3%.

NIHB Mental Health expenditures increased by 76.8% over this same time period from $12.3 million in 2007/08 to $21.7 million in 2016/17.

Decreases in 'Other' expenditures in 2009/10 and 2013/14 can be attributed to the Government of Alberta eliminating Alberta health care insurance premiums for all Alberta residents in 2009 and to the transfer of responsibility for health care insurance premiums for First Nations clients residing in British Columbia to the First Nations Health Authority (FNHA) in 2013. This expenditure category also includes funding arrangements with the FNHA for Bill C-3 and Qalipu clients and for payment of premiums for Inuit clients in British Columbia, as well as with regional Indigenous organizations that employ NIHB Navigators to act as a resource for communities, organizations or individuals who need assistance or information on the NIHB Program.

| Benefit | 2007/08 | 2008/09 | 2009/10 | 2010/11 | 2011/12 | 2012/13 | 2013/14 | 2014/15 | 2015/16 | 2016/17 |

|---|---|---|---|---|---|---|---|---|---|---|

| Medical Transportation | $262,294 | $280,446 | $301,673 | $311,760 | $333,304 | $351,424 | $352,036 | $357,963 | $375,904 | $417,035 |

| Pharmacy | $403,248 | $418,968 | $435,097 | $440,768 | $459,359 | $462,699 | $416,165 | $422,350 | $456,430 | $494,520 |

| Dental | $165,576 | $176,382 | $194,918 | $215,796 | $219,057 | $222,706 | $207,179 | $201,886 | $217,109 | $235,831 |

| Vision Care | $25,621 | $26,577 | $27,779 | $29,219 | $29,780 | $32,167 | $31,459 | $29,704 | $30,017 | $32,370 |

| Mental Health | $12,289 | $11,380 | $12,516 | $12,083 | $12,936 | $14,337 | $14,152 | $15,581 | $16,193 | $21,728 |

| Other | $29,211 | $26,430 | $17,110 | $18,428 | $19,868 | $21,257 | $5,406 | $4,005 | $4,858 | $5,974 |

| Total | $898,239 | $940,182 | $989,094 | $1,028,053 | $1,074,304 | $1,074,591 | $1,026,397 | $1,031,488 | $1,100,512 | $1,207,458 |

| Annual % Change | 4.9% | 4.7% | 5.2% | 3.9% | 4.5% | 2.8% | -7.1% | 0.5% | 6.7% | 9.7% |

| Source: FIRMS adapted by by Business Support, Audit and Negotiations Division | ||||||||||

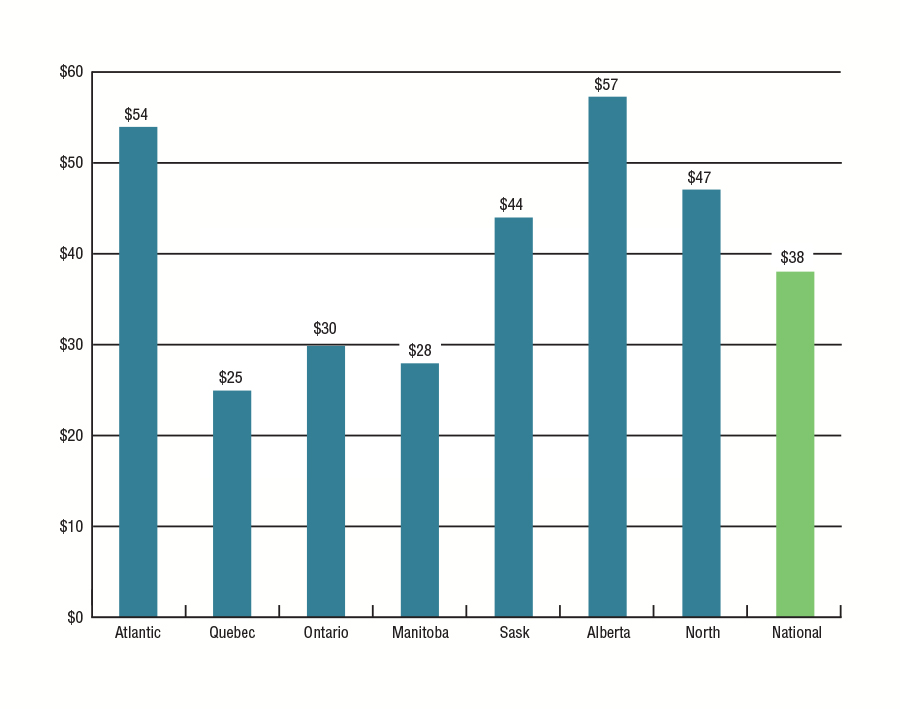

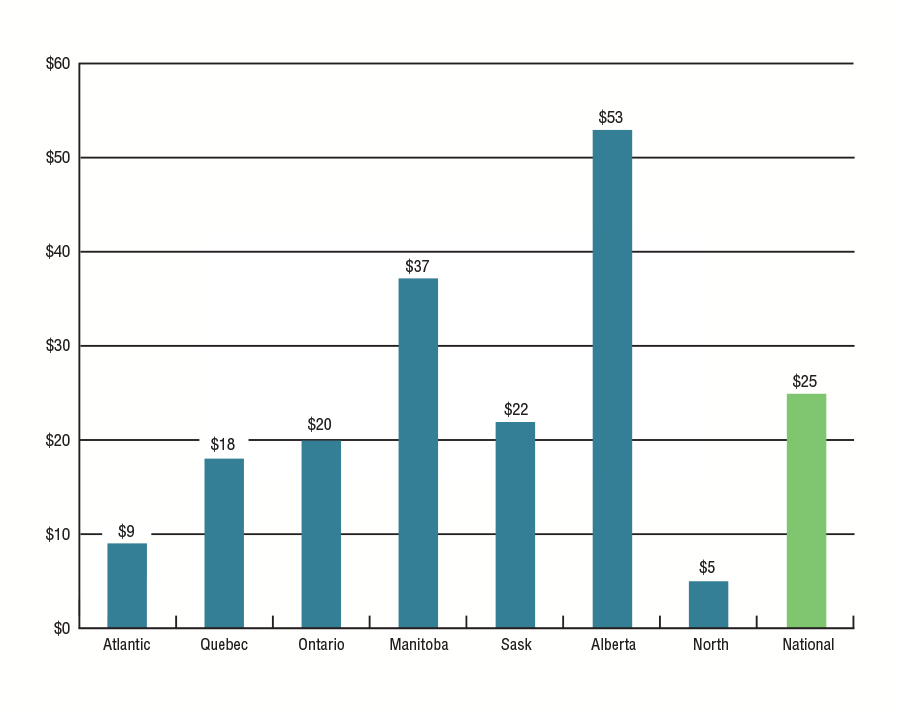

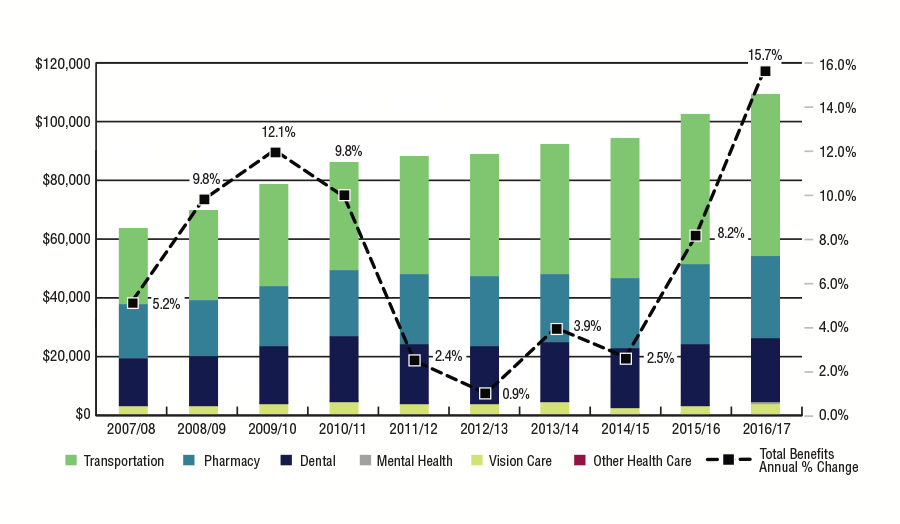

Figure 3.9: Per Capita NIHB Expenditures by Region

2016/17

The national per capita expenditure for all benefits in 2016/17 was $1,388. Manitoba had the highest per capita cost in 2016/17 at $1,910. The Northern Region followed with a per capita cost of $1,594. The higher than average per capita cost for these regions is partly attributable to high medical transportation costs due to the large number of First Nations and Inuit clients living in remote or fly-in only northern communities. In contrast, the Atlantic Region had the lowest per capita cost of $851, due to the comparatively low medical transportation expenditures in the region.

Figure 3.9: Per Capita NIHB Expenditures by Region 16/17

Source: FIRMS and SVS adapted by by Business Support, Audit and Negotiations Division

Text Equivalent

| Region | Per Capita |

|---|---|

| Atlantic | $851 |

| Quebec | $1,295 |

| Ontario | $1,118 |

| Manitoba | $1,910 |

| Saskatchewan | $1,479 |

| Alberta | $1,512 |

| North | $1,594 |

| National | $1,388 |

Section 4: NIHB Pharmacy Expenditure and Utilization Data

The NIHB Program covers a comprehensive range of prescription drugs and over-the-counter medications listed on the NIHB Drug Benefit List (DBL). Coverage of pharmacy benefits and services are based on professional judgment, consistent with current best practices of health services delivery and evidence-based standards of care, with particular emphasis on client safety, intended to contribute to better health outcomes in a fair, equitable and cost-effective manner, while recognizing the unique health needs of First Nations and Inuit clients. Policies to achieve this objective have and will continue to be adopted by the NIHB Program.

In addition, a limited but comprehensive range of medical supplies and equipment (MS&E) items are covered by the Program. Like prescription and over-the-counter medications, MS&E benefits are evidence-based and covered in accordance with Program policies. Clients must obtain a prescription from a prescriber that is recognized by the NIHB Program for MS&E items, and have the prescription filled at an approved provider. Items covered under the MS&E benefit include:

- Audiology benefits, such as hearing aids and repairs;

- Medical equipment, such as wheelchairs and walkers;

- Medical supplies, such as bandages and dressings;

- Orthotics and custom footwear;

- Pressure garments;

- Prosthetics;

- Oxygen supplies and equipment; and

- Respiratory supplies and equipment.

In 2016/17, the NIHB Program paid for pharmacy and MS&E claims made by a total of 523,386 First Nations and Inuit clients. The total expenditure for these claims was $494.5 million or 41.0% of total NIHB expenditures. Of all the NIHB Program benefits, the pharmacy benefit accounts for the largest share of expenditures and is the benefit most utilized by clients.

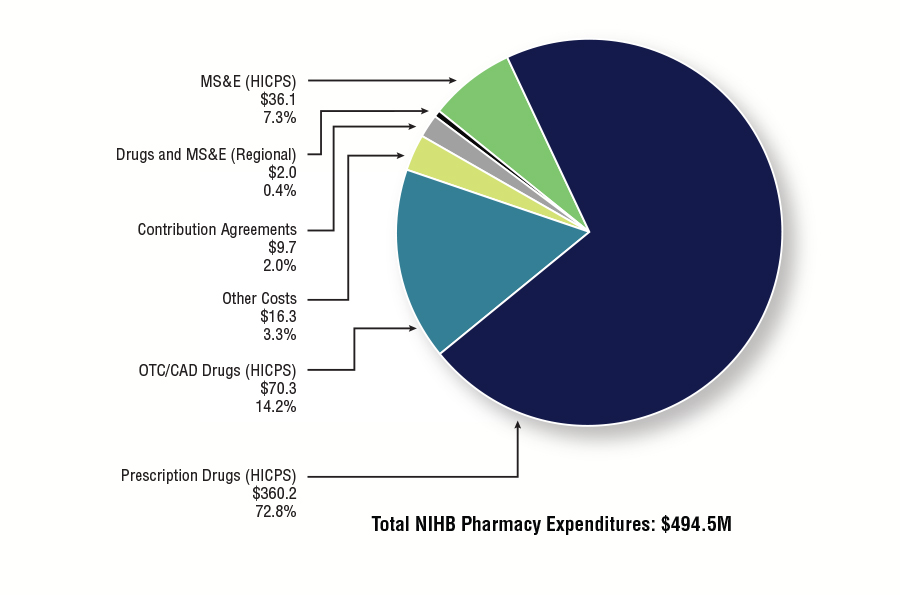

Figure 4.1: Distribution of NIHB Pharmacy and MS&E Expenditures ($ Millions)

2016/17

In 2016/17, NIHB Pharmacy and MS&E benefits totalled $494.5 million or 41.0% of total NIHB expenditures.

Figure 4.1 illustrates the components of pharmacy and MS&E expenditures under the NIHB Program. The cost of prescription drugs paid through the Health Information and Claims Processing Services (HICPS) system was the largest component, accounting for $360.2 million or 72.8% of all NIHB Pharmacy expenditures, followed by over-the-counter (OTC) drugs and controlled access drugs (CAD) which totalled $70.4 million or 14.2%. Medical supplies and equipment (MS&E) items paid through HICPS was the third largest component in the pharmacy benefit at $36.1 million or 7.3%.

Drugs and MS&E (Regional), at $2.0 million or 0.4%, refers to regionally managed prescription drugs and OTC medications. This category also includes MS&E items paid through Indigenous Services Canada regional offices.

Contribution agreements, which accounted for $9.7 million or 2.0% of total pharmacy and MS&E benefit costs, are used to fund the provision of pharmacy benefits through agreements such as those with the Mohawk Council of Akwesasne in Ontario and the Bigstone Cree Nation in Alberta.

Other costs totalled $16.3 million or 3.3% in 2016/17. Included in this total are Headquarters contract and claims processing expenditures related to the HICPS system.

Figure 4.1: Distribution of NIHB Pharmacy and MS&E Expenditures ($ Millions) 2016/17

Source: FIRMS adapted by Business Support, Audit and Negotiations Division

Text Equivalent

| Million $ | Proportion | |

|---|---|---|

| Prescription Drugs (HICPS) | $360.2 | 72.8% |

| OTC/CAD Drugs (HICPS) | $70.3 | 14.2% |

| Other Costs | $16.3 | 3.3% |

| Contribution Agreements | $9.7 | 2.0% |

| Drugs and MS&E (Regional) | $2.0 | 0.4% |

| MS&E (HICPS) | $36.1 | 7.3% |

| Total NIHB Pharmacy Expenditures | $494.5 | 100.0% |

Figure 4.2: Total NIHB Pharmacy Expenditures by Type and Region ($ 000's)

2016/17

Prescription drug costs paid through the HICPS system represented the largest component of total costs accounting for $360.2 million or 72.8% of all NIHB Pharmacy costs. The Saskatchewan Region had the largest proportion of these costs at 22.4%, followed by Manitoba at 20.3% and the Ontario Region at 19.6%.

The next highest component was over-the-counter (OTC) and controlled access drug (CAD) costs at $70.3 million or 14.5%. The regions of Manitoba (22.0%), Ontario (21.0%) and Saskatchewan (19.8%) had the largest proportions of these costs in 2016/17.

The third highest component was the combined medical supplies and equipment (MS&E) category at $36.1 million (7.3%). The Alberta Region (22.8%) had the highest proportion of MS&E costs in 2016/17. This was followed by the Saskatchewan Region (22.2%), the Manitoba Region (17.6%), and the Ontario Region (15.2%).

| Region | Operating | Total Operating Costs | Total Contribution Costs | Total Costs | |||||

|---|---|---|---|---|---|---|---|---|---|

| Prescription Drugs | OTC/CAD Drugs | Drugs/MS&E Regional | Medical Supplies | Medical Equipment | Other Costs | ||||

| Atlantic | $23,437 | $5,467 | $6 | $2,154 | $834 | $0 | $31,899 | $0 | $31,899 |

| Quebec | $37,151 | $8,252 | $47 | $1,275 | $720 | $0 | $47,444 | $0 | $47,444 |

| Ontario | $70,469 | $14,769 | $13 | $4,125 | $1,345 | $0 | $90,721 | $3,380 | $94,101 |

| Manitoba | $72,942 | $15,474 | $0 | $4,497 | $1,844 | $0 | $94,757 | $0 | $94,757 |

| Saskatchewan | $80,601 | $13,921 | $1,508 | $5,456 | $2,554 | $0 | $104,040 | $42 | $104,082 |

| Alberta | $53,835 | $9,171 | $23 | $5,990 | $2,227 | $0 | $71,246 | $6,023 | $77,269 |

| North | $21,603 | $3,213 | $409 | $2,074 | $977 | $0 | $28,276 | $212 | $28,488 |

| Headquarters | $0 | $0 | $0 | $0 | $0 | $16,302 | $16,302 | $0 | $16,302 |

| Total | $360,195 | $70,294 | $2,006 | $25,570 | $10,500 | $16,302 | $484,867 | $9,657 | $494,524 |

| Source: FIRMS adapted by Business Support, Audit and Negotiations Division | |||||||||

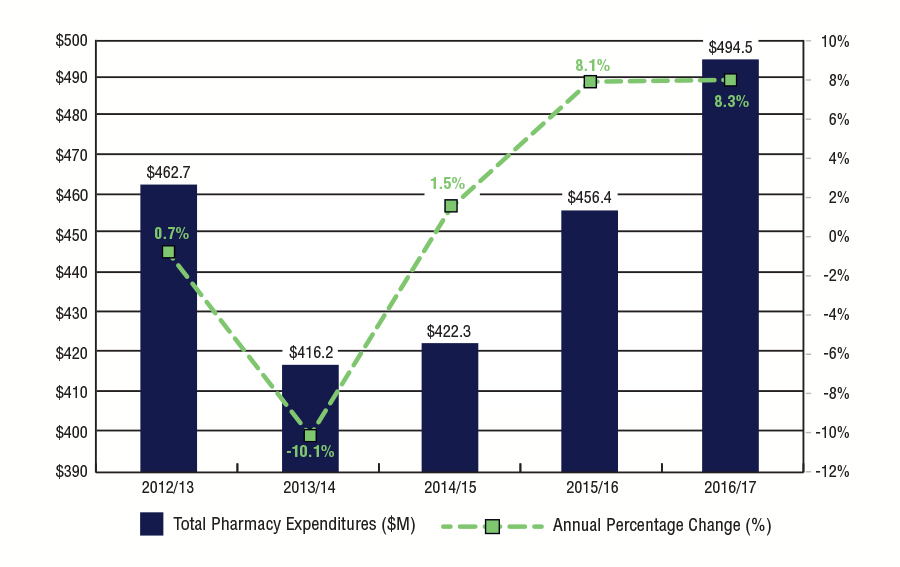

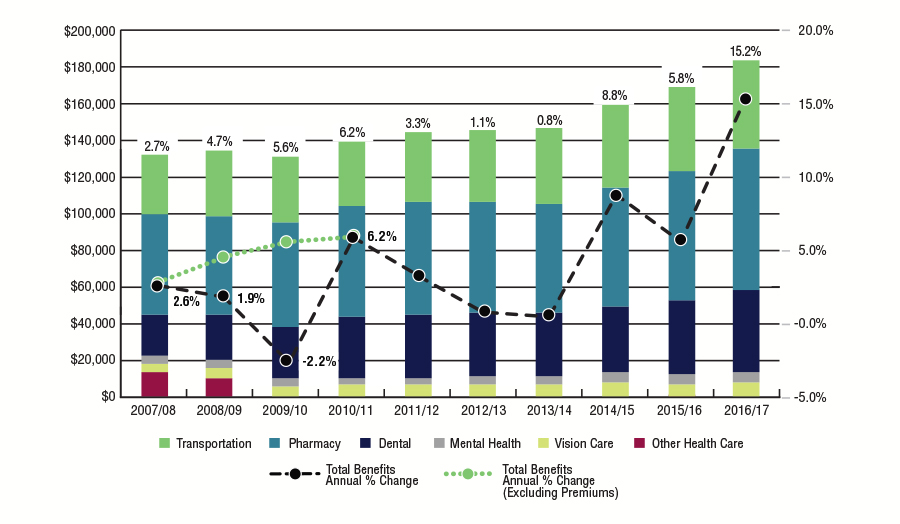

Figure 4.3: Annual NIHB Pharmacy Expenditures

2012/13 to 2016/17

NIHB Pharmacy expenditures increased by 8.3% during fiscal year 2016/17. Over the past five years, growth in pharmacy expenditures has ranged from a high of 8.3% in 2016/17 to a low of -10.1% in 2013/14. If expenditures for FNHA eligible clients are excluded from 2012/13 and 2013/14 total NIHB expenditures, then the growth rate for 2013/14 would have been 1.5%.

The five year annualized growth rate for NIHB Pharmacy expenditures is 1.5%. Growth has been low and steady over the past five years. Reasons for this stability include the introduction of lower cost generic drugs as they become available on the market, optimizing drug utilization, policy changes designed to promote NIHB Program sustainability, such as the implementation of the NIHB Short-Term Dispensing Policy in 2008/09, and changes in generic pricing policies in key provinces (Quebec, Ontario, Saskatchewan and British Columbia).

Figure 4.3.1: NIHB Pharmacy Expenditures and Annual Percentage Change

Source: FIRMS adapted by Business Support, Audit and Negotiations Division

Text Equivalent

| Year | Total Pharmacy Expenditures ($M) | Annual Percentage Change (%) |

|---|---|---|

| 2012/13 | $462.7 | 0.7% |

| 2013/14 | $416.2 | -10.1% |

| 2014/15 | $422.3 | 1.5% |

| 2015/16 | $456.4 | 8.1% |

| 2016/17 | $494.5 | 8.3% |

| Region | 2012/13 | 2013/14 | 2014/15 | 2015/16 | 2016/17 |

|---|---|---|---|---|---|

| Atlantic | $29,979 | $27,517 | $28,398 | $30,064 | $31,899 |

| Quebec | $40,393 | $40,825 | $42,581 | $44,206 | $47,444 |

| Ontario | $77,131 | $78,510 | $81,982 | $88,872 | $94,101 |

| Manitoba | $80,676 | $77,034 | $81,059 | $87,997 | $94,757 |

| Saskatchewan | $74,646 | $78,546 | $83,361 | $91,170 | $104,082 |

| Alberta | $60,584 | $58,777 | $64,087 | $69,992 | $77,265 |

| North | $15,749 | $16,874 | $16,678 | $16,546 | $16,302 |

| Headquarters | $462,699 | $416,165 | $422,350 | $456,430 | $494,520 |

| Source: FIRMS adapted by Business Support, Audit and Negotiations Division | |||||

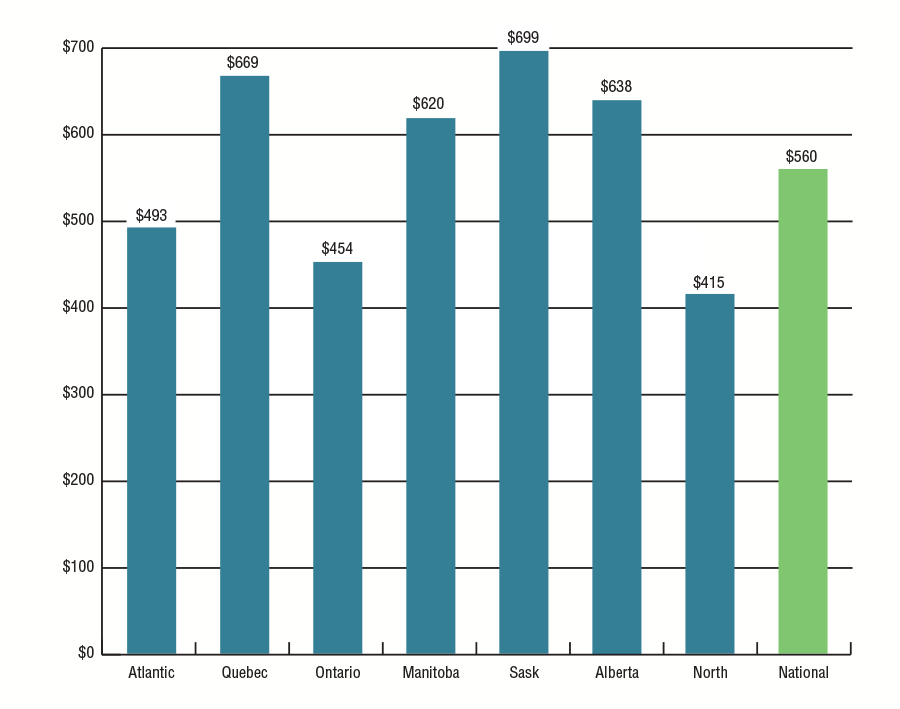

Figure 4.4: Per Capita NIHB Pharmacy Expenditures by Region

2016/17

In 2016/17, the national per capita expenditure for NIHB Pharmacy benefits was $560. This was an increase of 6.9% from the $524 recorded in 2015/16.

The Saskatchewan Region had the highest per capita NIHB Pharmacy expenditure at $699, followed by the Quebec Region at $669.

The Northern Region had the lowest per capita expenditure at $415 followed by the Ontario Region at $454. A relatively low per capita expenditure in the North is attributed to lower than average utilization rates and also a younger population utilizing lower cost medications. (Refer to Figure 4.6)

Figure 4.4: Per Capita NIHB Pharmacy Expenditures by Region 2016/17

Source: FIRMS and SVS adapted by Business Support, Audit and Negotiations Division

Text Equivalent

| Region | Expenditure per Capita |

|---|---|

| Atlantic | $493 |

| Quebec | $669 |

| Ontario | $454 |

| Manitoba | $620 |

| Saskatchewan | $699 |

| Alberta | $638 |

| North | $415 |

| National | $560 |

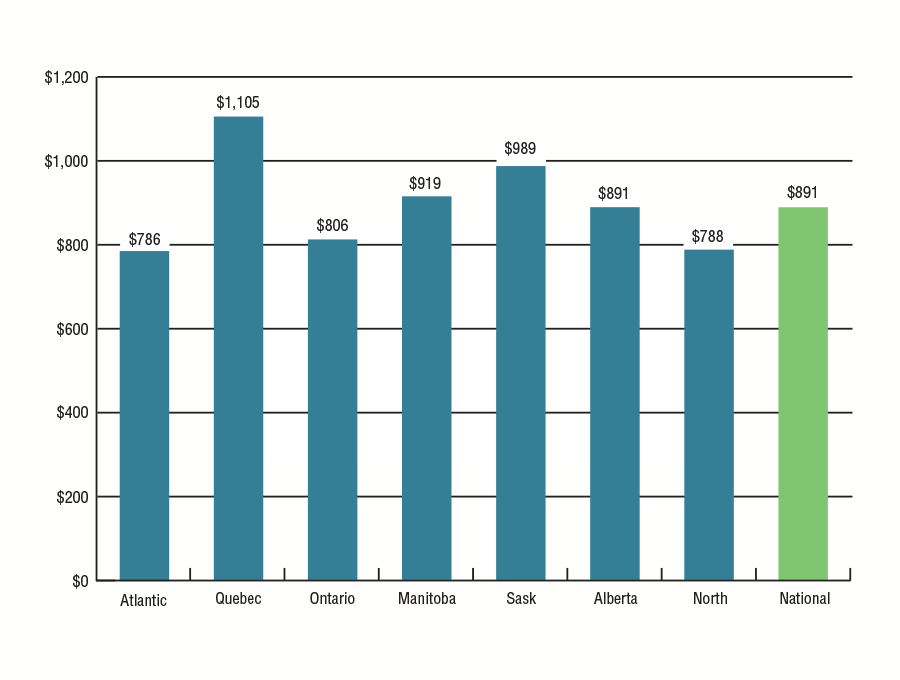

Figure 4.5: NIHB Pharmacy Operating Expenditures per Claimant by Region

2016/17

Expenditures per claimant are based on the total cost of pharmacy claims processed through the HICPS system, divided by the number of clients who submitted at least one pharmacy claim.

In 2016/17, the national average per claimant expenditure was $891, an increase of 7.0% over 2015/16.

The Quebec Region had the highest average NIHB Pharmacy operating expenditure per claimant at $1,105, followed by Saskatchewan at $989.

Figure 4.5: NIHB Pharmacy OperatingExpenditures per Claimant by Region 2016/17

Source: HICPS and SVS adapted by Business Support, Audit and Negotiations Division

Text Equivalent

| Region | Cost per Claimant |

|---|---|

| Atlantic | $786 |

| Quebec | $1,105 |

| Ontario | $806 |

| Manitoba | $919 |

| Saskatchewan | $989 |

| Alberta | $891 |

| North | $788 |

| National | $891 |

Figure 4.6: NIHB Pharmacy Utilization Rates by Region

2012/13 to 2016/17

Utilization rates represent the number of clients who received at least one pharmacy benefit paid through theHICPS system in the fiscal year, as a proportion of the total number of eligible clients.

In 2016/17, the national utilization rate was 61% for NIHB Pharmacy benefits paid through the HICPS system.

The rates understate the actual level of service as the data do not include pharmacy services provided through contribution agreements and benefits provided through community health facilities or provided completely via alternate health coverage. For example, if the Bigstone Cree Nation client population were removed from the Alberta Region's population because the HICPS system does not capture any data on services used by this population, the utilization rate for pharmacy benefits in Alberta would have been 71% in 2016/17. Similarly for the Ontario Region, if the Akwesasne client population were removed from the Ontario Region's population, the utilization rate for pharmacy benefits would have been 58%. If both the Bigstone and Akwesasne client populations were removed from the overall NIHB population, the national utilization rate for pharmacy benefits would have been 63%.

| Region | Pharmacy Utilization | ||||

|---|---|---|---|---|---|

| 2012/13 | 2013/14 | 2014/15 | 2015/16 | 2016/17 | |

| Atlantic | 61% | 62% | 62% | 62% | 63% |

| Quebec | 59% | 59% | 60% | 60% | 60% |

| Ontario | 55% | 54% | 54% | 54% | 54% |

| Manitoba | 67% | 66% | 66% | 67% | 67% |

| Saskatchewan | 70% | 70% | 70% | 70% | 70% |

| Alberta | 66% | 66% | 66% | 66% | 66% |

| Yukon | 60% | 59% | 60% | 60% | 60% |

| N.W.T. | 53% | 53% | 54% | 54% | 55% |

| Nunavut | 46% | 46% | 47% | 46% | 47% |

| National | 62% | 61% | 61% | 61% | 61% |

| Source: HICPS and SVS adapted by Business Support, Audit and Negotiations Division | |||||

Figure 4.7: NIHB Pharmacy Claimants by Age Group, Gender and Region

2016/17

Of the 853,088 clients eligible to receive benefits under the NIHB Program, a total of 523,386 claimants, representing 61% of the NIHB client population, received at least one pharmacy item paid through the Health Information and Claims Processing Services (HICPS) system in 2016/17. Of this total, 295,340 were female (56%) and 228,046 were male (44%). This compares to the total eligible population where 51% were female and 49% were male.

The average age of pharmacy claimants was 35 years. The average age for female and male claimants was 35 and 34 years of age, respectively.

| Region | Atlantic | Quebec | Ontario | Manitoba | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Age Group | Male | Female | Total | Male | Female | Total | Male | Female | Total | Male | Female | Total |

| 0-4 | 830 | 868 | 1,698 | 1,045 | 983 | 2,028 | 2,111 | 2,014 | 4,125 | 3,345 | 3,143 | 6,488 |

| 5-9 | 1,236 | 1,244 | 2,480 | 1,347 | 1,386 | 2,733 | 3,045 | 3,133 | 6,178 | 4,554 | 4,665 | 9,219 |

| 10-14 | 1,253 | 1,278 | 2,531 | 1,198 | 1,217 | 2,415 | 2,927 | 2,897 | 5,824 | 3,955 | 4,090 | 8,045 |

| 15-19 | 1,254 | 1,823 | 3,077 | 1,069 | 1,738 | 2,807 | 3,185 | 4,603 | 7,788 | 3,705 | 4,941 | 8,646 |

| 20-24 | 1,308 | 2,239 | 3,547 | 1,179 | 2,058 | 3,237 | 3,474 | 5,793 | 9,267 | 3,847 | 5,702 | 9,641 |

| 25-29 | 1,279 | 1,943 | 3,222 | 1,215 | 2,019 | 3,234 | 3,680 | 5,705 | 9,385 | 3,792 | 5,375 | 9,494 |

| 30-34 | 1,153 | 1,677 | 2,830 | 1,079 | 1,789 | 2,868 | 3,470 | 5,011 | 8,481 | 3,326 | 4,539 | 7,865 |

| 35-39 | 1,147 | 1,511 | 2,658 | 1,124 | 1,568 | 2,692 | 3,340 | 4,731 | 8,071 | 3,093 | 3,843 | 6,936 |

| 40-44 | 1,176 | 1,558 | 2,734 | 1,152 | 1,579 | 2,731 | 3,477 | 4,456 | 7,933 | 3,082 | 3,764 | 6,846 |

| 45-49 | 1,387 | 1,631 | 3,018 | 1,351 | 1,715 | 3,066 | 3,754 | 4,717 | 8,471 | 3,171 | 3,930 | 7,101 |

| 50-54 | 1,360 | 1,641 | 3,001 | 1,447 | 1,932 | 3,379 | 4,054 | 5,093 | 9,147 | 3,093 | 3,607 | 6,700 |

| 55-59 | 1,232 | 1,582 | 2,814 | 1,460 | 1,832 | 3,292 | 3,752 | 4,698 | 8,450 | 2,535 | 3,035 | 5,570 |

| 60-64 | 1,063 | 1,419 | 2,482 | 1,177 | 1,555 | 2,732 | 2,904 | 3,822 | 6,726 | 1,765 | 2,240 | 4,005 |

| 65+ | 1,924 | 2,541 | 4,465 | 2,273 | 3,411 | 5,684 | 5,081 | 7,626 | 12,707 | 2,756 | 3,749 | 6,505 |

| Total | 17,602 | 22,955 | 40,557 | 18,116 | 24,782 | 42,898 | 48,254 | 64,299 | 112,553 | 46,019 | 57,042 | 103,061 |

| Average Age | 37 | 38 | 38 | 38 | 40 | 39 | 38 | 39 | 39 | 32 | 33 | 33 |

| Source: HICPS and SVS adapted by Business Support, Audit and Negotiations Division | ||||||||||||

| Region | Saskatchewan | Alberta | North | Total | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Age Group | Male | Female | Total | Male | Female | Total | Male | Female | Total | Male | Female | Total |

| 0-4 | 3,150 | 3,052 | 6,202 | 2,640 | 2,528 | 5,168 | 1,223 | 1,134 | 2,357 | 14,623 | 13,983 | 28,606 |

| 5-9 | 4,822 | 4,953 | 9,775 | 3,860 | 3,952 | 7,812 | 1,184 | 1,117 | 2,301 | 20,196 | 20,581 | 40,777 |

| 10-14 | 4,244 | 4,573 | 8,817 | 3,284 | 3,452 | 6,736 | 945 | 936 | 1,881 | 17,929 | 18,570 | 36,499 |

| 15-19 | 3,846 | 5,377 | 9,223 | 2,984 | 3,933 | 6,917 | 918 | 1,623 | 2,541 | 17,126 | 24,272 | 41,398 |

| 20-24 | 3,847 | 6,042 | 9,889 | 3,152 | 4,424 | 7,576 | 1,083 | 2,121 | 3,204 | 18,051 | 28,755 | 46,806 |

| 25-29 | 3,951 | 5,984 | 9,935 | 3,035 | 4,212 | 7,247 | 1,082 | 2,223 | 3,305 | 18,230 | 28,129 | 46,359 |

| 30-34 | 3,470 | 4,928 | 8,398 | 2,855 | 3,677 | 6,532 | 1,043 | 1,782 | 2,825 | 16,576 | 23,699 | 40,275 |

| 35-39 | 3,218 | 4,000 | 7,218 | 2,454 | 3,206 | 5,660 | 906 | 1,519 | 2,425 | 15,444 | 20,637 | 36,081 |

| 40-44 | 2,930 | 3,799 | 6,729 | 2,258 | 2,800 | 5,058 | 858 | 1,344 | 2,202 | 15,087 | 19,521 | 34,608 |

| 45-49 | 3,032 | 3,749 | 6,781 | 2,280 | 2,679 | 4,959 | 1,178 | 1,518 | 2,696 | 16,333 | 20,185 | 36,518 |

| 50-54 | 2,773 | 3,378 | 6,151 | 2,125 | 2,626 | 4,751 | 1,081 | 1,476 | 2,557 | 16,088 | 20,028 | 36,116 |

| 55-59 | 2,292 | 2,803 | 5,095 | 1,732 | 2,185 | 3,917 | 862 | 1,239 | 2,101 | 13,969 | 17,578 | 31,547 |

| 60-64 | 1,522 | 1,957 | 3,479 | 1,188 | 1,618 | 2,806 | 650 | 904 | 1,554 | 10,338 | 13,639 | 23,977 |

| 65+ | 2,493 | 3,455 | 5,948 | 1,953 | 2,867 | 4,820 | 1,482 | 1,916 | 3,398 | 18,056 | 25,763 | 43,819 |

| Total | 45,590 | 58,050 | 103,640 | 35,800 | 44,159 | 79,959 | 14,495 | 20,852 | 35,347 | 228,046 | 295,340 | 523,386 |

| Average Age | 31 | 32 | 32 | 31 | 32 | 32 | 35 | 36 | 36 | 34 | 35 | 35 |

| Source: HICPS and SVS adapted by Business Support, Audit and Negotiations Division | ||||||||||||

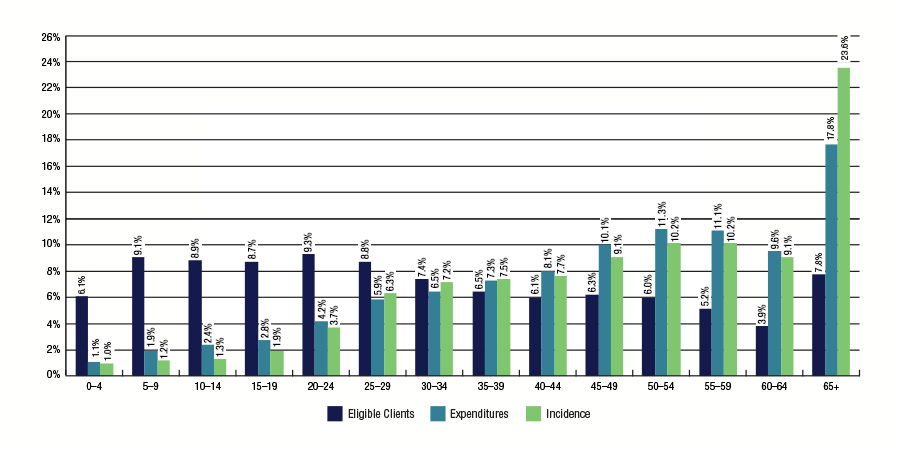

Figure 4.8: Distribution of Eligible NIHB Population, Pharmacy Expenditures and Pharmacy Incidence by Age Group

2016/17

The main drivers of NIHB Pharmacy expenditures are the cost of medications, the volume of claimsFootnote 2 submitted and the professional fees associated with filling these claims. In 2016/17, 6.1% of all clients were in the 0 to 4 age group, but this group accounted for only 1.0% of all pharmacy claims made and only 1.1% of total pharmacy expenditures. In contrast, 7.8% of all eligible clients were in the 65+ age group, but accounted for 23.6 % of all pharmacy claims submitted and 17.8 % of total pharmacy expenditures.

During 2016/17, the average claimant aged 65 or more submitted 94 claims compared to 66 claims for their counterpart in the 60 to 64 age group and 6 claims for the average claimant in the 0 to 4 age group.

Figure 4.8: Distribution of Eligible NIHB Population, Pharmacy Expenditures and Pharmacy Incidence by Age Group 2016/17

Source: HICPS and SVS adapted by Business Support, Audit and Negotiations Division

Text Equivalent

| Age | Eligible Clients | Expenditures | Incidence |

|---|---|---|---|

| 0-4 | 6.1% | 1.1% | 1.0% |

| 5-9 | 9.1% | 1.9% | 1.2% |

| 10-14 | 8.9% | 2.4% | 1.3% |

| 15-19 | 8.7% | 2.8% | 1.9% |

| 20-24 | 9.3% | 4.2% | 3.7% |

| 25-29 | 8.8% | 5.9% | 6.3% |

| 30-34 | 7.4% | 6.5% | 7.2% |

| 35-39 | 6.5% | 7.3% | 7.5% |

| 40-44 | 6.1% | 8.1% | 7.7% |

| 45-49 | 6.3% | 10.1% | 9.1% |

| 50-54 | 6.0% | 11.3% | 10.2% |

| 55-59 | 5.2% | 11.1% | 10.2% |

| 60-64 | 3.9% | 9.6% | 9.1% |

| 65+ | 7.8% | 17.8% | 23.6% |

An examination of pharmacy benefit cost per NIHB claimant indicates that these expenditures vary according to age. For example, in 2016/17 the average cost per child aged 0 to 4 years was $185. The cost increased steadily for every age group, with claimants aged 35-39 having an average cost of $941, comparable to the total average claimant cost of $891. Claimants over 65 years of age had the highest cost per claimant with an average of $1,893 for all pharmaceutical services received throughout the fiscal year.

Figure 4.9: NIHB Top Ten Therapeutic Classes by Number of Claimants

2016/17

Figure 4.9 ranks the top ten therapeutic classes according to number of claimants. In 2016/17, Non-Steroidal Anti-Inflammatory Drugs (NSAID) had the highest number of distinct claimants at 200 thousand, an increase of 1.4% over 2015/16. Penicillins such as Amoxil (Amoxicillin) ranked second in number of claimants with 162 thousand followed by Opioid Agonists with 121 thousand claimants.

| Therapeutic Classification | Claimants | % Change from 2015/16 | Examples of Product in the Therapeutic Class |

|---|---|---|---|

| Non-Steroidal Anti-Inflammatory Drugs (NSAID) | 200,430 | 1.4% | Voltaren (Diclofenac) |

| Penicillins | 161,920 | 1.3% | Amoxil (Amoxicillin) |

| Opioid Agonists | 120,875 | 1.3% | Statex (Morphine Sulphate) |

| Miscellaneous Analgesics and Antipyretics | 117,887 | 4.6% | Tylenol (Acetaminophen) |

| Antidepressants | 90,378 | 7.2% | Losec (Omeprazole) |

| Proton Pump Inhibitors | 89,120 | 4.0% | Ventolin (Salbutamol) |

| Beta-Adrenergic Agonists | 86,837 | 2.4% | Effexor (Venlafaxine) |

| SMMA - Anti-inflammatory Agents | 79,769 | 3.5% | Cortate Cream (Hydrocortisone) |

| Cephalosporins | 75,534 | 2.3% | Keflex (Cephalexin) |

| Adrenals | 70,047 | 0.1% | Flovent (Fluticasone Propionate) |

| Source: HICPS adapted by Business Support, Audit and Negotiations Division | |||

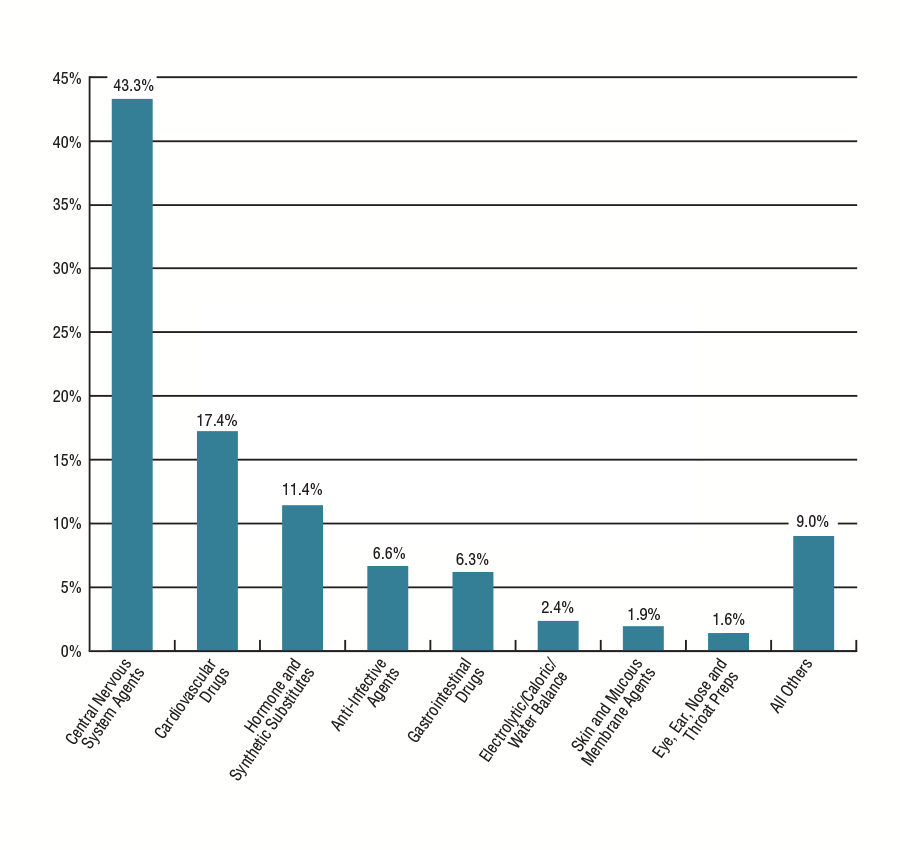

Figure 4.10: NIHB Prescription Drug Claims Incidence by Pharmacologic Therapeutic Class

2016/17

Figure 4.10 demonstrates variation in claims incidence by therapeutic classification for prescription drugs.

Central nervous system agents, which include drug classes such as analgesics and sedatives, accounted for 43.3% of all prescription drug claims in 2016/17. Central nervous systems agents are used in the treatment of diverse health conditions such as arthritis, depression or epilepsy.

Cardiovascular drugs had the next highest share of prescription drug claims at 17.4% followed by hormones and synthetic substitutes, which consist primarily of oral contraceptives and insulin, at 11.4%. Cardiovascular drugs are used to treat clients with arrhythmias, hypercholesterolemia or ischemic heart disease. Hormones and synthetic substitutes are given to clients to treat conditions such as diabetes or hypothyroidism.

Figure 4.10: NIHB Prescription Drug Claims Incidence by Pharmacologic Therapeutic Class 2016/17

Source: HICPS adapted by Business Support, Audit and Negotiations Division

Text Equivalent

| Sub-benefit | % |

|---|---|

| Central Nervous System Agents | 43.3% |

| Cardiovascular Drugs | 17.4% |

| Hormones and Synthetic Substitutes | 11.4% |

| Anti-Infective Agents | 6.6% |

| Gastrointestinal Drugs | 6.3% |

| Electrolytic/Caloric/Water Balance | 2.4% |

| Skin and Mucous Membrane Agents | 1.9% |

| Eye, Ear, Nose and Throat Preps | 1.6% |

| All Others | 9.0% |

Figure 4.11: NIHB Over-the-Counter Drugs (Including Controlled Access Drugs - CAD) Claims Incidence by Pharmacologic Therapeutic Class

2016/17

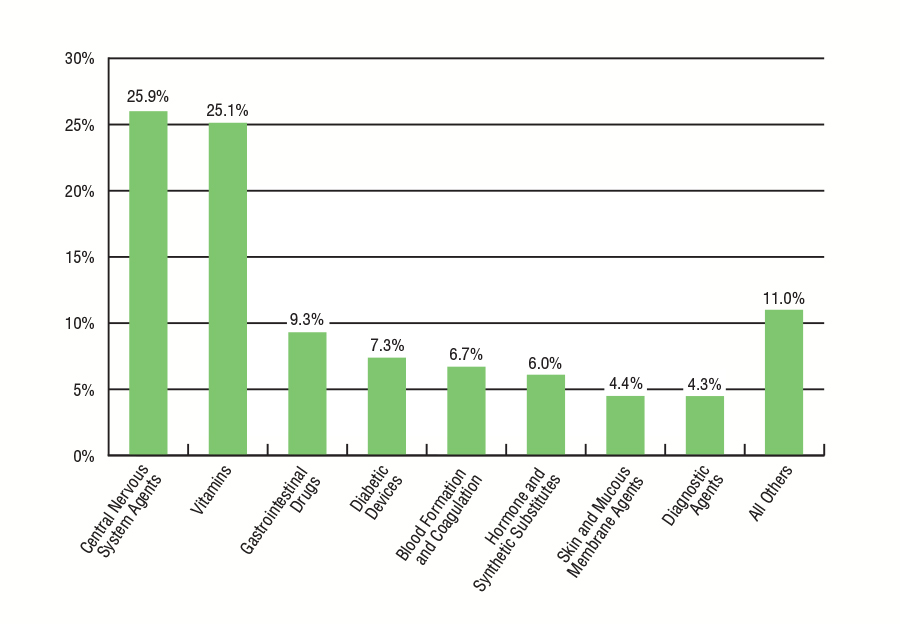

Figure 4.11 demonstrates variation in claims incidence by therapeutic classification for over-the-counter (OTC) drugs. The NIHB Program covers the cost of some OTC drugs. To be reimbursed by the NIHB Program, all OTC drugs require a prescription from a recognized health professional who has the authority to prescribe in their province or territory of practice.

OTC central nervous system agents, which are drugs used to manage pain such as headaches (e.g. acetaminophen), accounted for 25.9% of all OTC drug claims.

Vitamins are the next highest category of OTC medication at 25.1%, followed by gastrointestinal products such as antacids and laxatives, which are used to treat heartburn and constipation, at 9.3%.

Figure 4.11: NIHB Over-the-Counter Drugs (Including Controlled Access Drugs - CAD) Claims Incidence by Pharmacologic Therapeutic Class 2016/17

Source: HICPS adapted by Business Support, Audit and Negotiations Division

Text Equivalent

| Sub-Benefit | Claims % |

|---|---|

| Central Nervous System Agents | 25.9% |

| Vitamins | 25.1% |

| Gastrointestinal Drugs | 9.3% |

| Diabetic Devices | 7.3% |

| Blood Formation and Coagulation | 6.7% |

| Hormones and Synthetic Substitutes | 6.0% |

| Skin and Mucous Membrane Agents | 4.4% |

| Diagnostic Agents | 4.3% |

| All Others | 11.0% |

Figure 4.12: Medical Supplies by Category and Claims Incidence

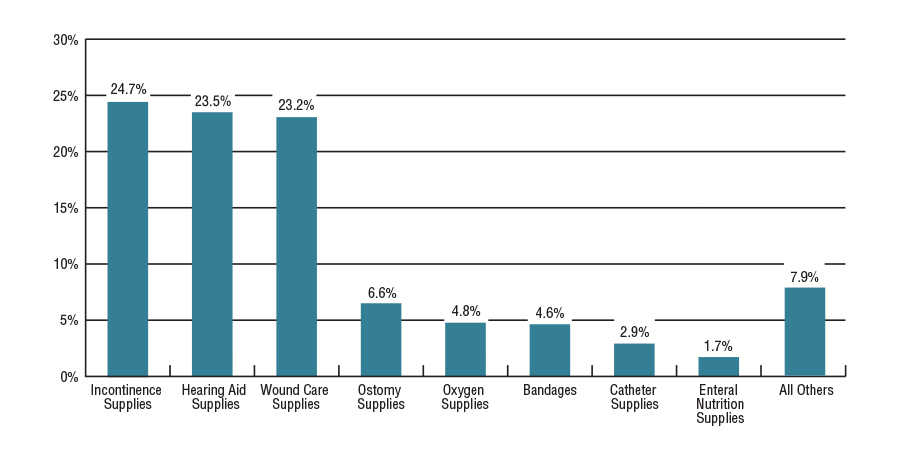

2016/17

Figure 4.12 demonstrates variation in medical supply claims incidence by category.

In 2016/17, incontinence supplies such as liners and pads accounted for 24.7% of all medical supply claims. Hearing aid supplies, such as batteries, represented 23.5% of all medical supply claims, followed by wound care supplies at 23.2%.

Figure 4.12: Medical Supplies by Category and Claims Incidence 2016/17

Source: HICPS adapted by Business Support, Audit and Negotiations Division

Text Equivalent

| Sub-Benefit | Claims % |

|---|---|

| Incontinence Supplies | 24.7% |

| Hearing Aid Supplies | 23.5% |

| Wound Care Supplies | 23.2% |

| Ostomy Supplies | 6.6% |

| Oxygen Supplies | 4.8% |

| Bandages | 4.6% |

| Catheter Supplies | 2.9% |

| Enteral Nutrition supplies | 1.7% |

| All Others | 7.9% |

Figure 4.13: NIHB Medical Equipment by Category and Claims Incidence

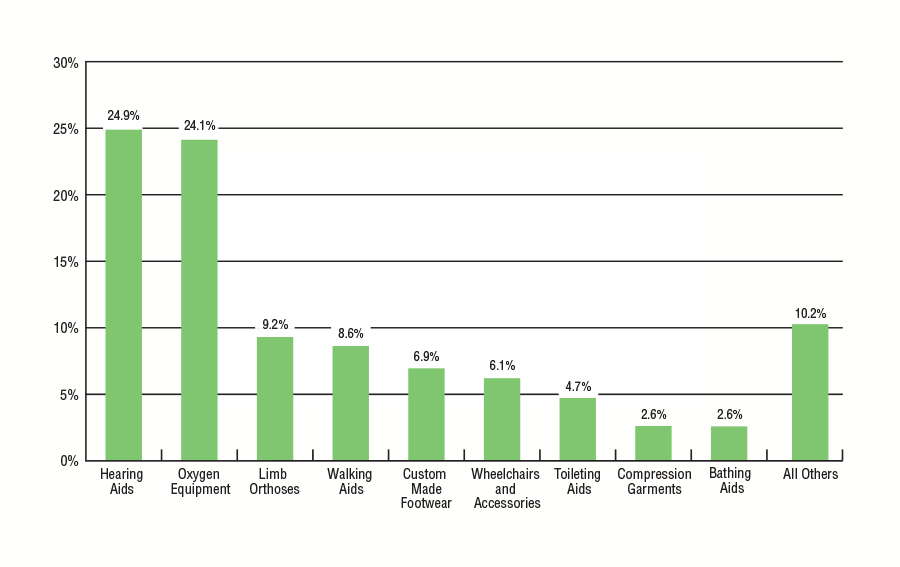

2016/17

Figure 4.13 demonstrates variation in medical equipment claims incidence by category.

Claims for hearing aids accounted for 24.9% of all medical equipment claims in 2016/17. Oxygen equipment was the next highest at 24.1%, followed by limb orthoses at 9.2% and walking aids at 8.6%.

The most significant increase in the proportion of total medical equipment claims over the fiscal year 2015/16 was in hearing aids which increased by 3.0 percentage points.

Figure 4.13: NIHB Medical Equipment by Category and Claims Incidence 2016/17

Source: HICPS adapted by Business Support, Audit and Negotiations Division

Text Equivalent

| Sub-Benefit | Claims % |

|---|---|

| Hearing Aids | 24.9% |

| Oxygen Equipment | 24.1% |

| Limb Orthoses | 9.2% |

| Walking Aids | 8.6% |

| Custom Made Footwear | 6.9% |

| Wheelchairs and Accessories | 6.1% |

| Toileting Aids | 4.7% |

| Compression Garments | 2.6% |

| Bathing Aids | 2.6% |

| All Others | 10.2% |

Section 5: NIHB Dental Expenditure and Utilization Data

The NIHB Program recognizes the importance of good oral health in contributing to the overall health of First Nations and Inuit clients, and covers a broad range of dental services in an effort to address the unique oral health needs of this client population.

In 2016/17, a total of 306,705 First Nations and Inuit clients accessed dental benefits through the NIHB Program, based on claims paid through the HICPS system. The total expenditure for dental benefit claims was $235.8 million or 19.5% of total NIHB expenditures. The dental benefit accounts for the third largest Program expenditure.

Coverage for NIHB Dental benefits is based on scientific evidence and current standards of care, and takes into consideration the client's current oral health status and treatment history and accumulated scientific research. Dental services must be provided by a licensed dental professional, such as a dentist, dental specialist, or denturist. Some dental services require predetermination prior to the initiation of treatment. Predetermination is a review that determines if the proposed dental service is covered under the Program's policies and criteria, as described in the NIHB Dental Benefits Guide.

The range of dental services covered by the NIHB Program, includes:

- Diagnostic services such as examinations and radiographs;

- Preventive services such as scaling, polishing, fluorides and sealants;

- Restorative services such as fillings and crowns;

- Endodontic services such as root canal treatments;

- Periodontal services such as deep scaling;

- Removable prosthodontic services such as dentures;

- Oral surgery services such as extractions;

- Orthodontic services to correct significant irregularities in teeth and jaws; and

- Adjunctive services such as general anaesthesia and sedation.

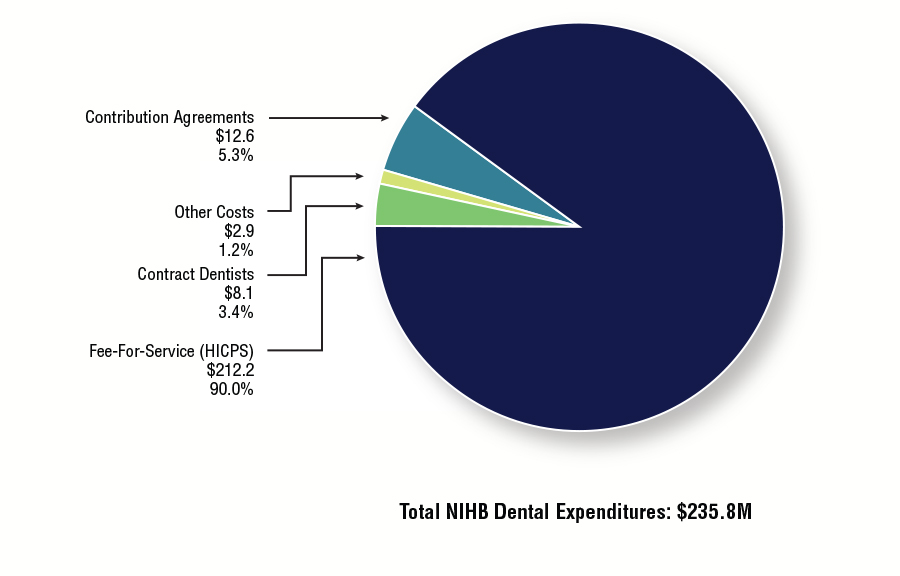

Figure 5.1: Distribution of NIHB Dental Expenditures ($ Millions)

2016/17

NIHB Dental expenditures totalled $235.8 million in 2016/17. Figure 5.1 illustrates the distinct components of dental expenditures under the NIHB Program. Fee-for-service dental costs paid through the Health Information and Claims Processing Services (HICPS) system represented the largest expenditure component, accounting for $212.2 million or 90.0% of all NIHB Dental costs.

The next highest component was contribution agreements, which accounted for $12.6 million or 5.3% of total dental expenditures. Contribution allocations were used to fund the provision of dental benefits through agreements such as those with the Mohawk Council of Akwesasne in Ontario and the Bigstone Cree Nation in Alberta.

Expenditures for contract dentists providing services to clients in remote communities totalled $8.1 million or 3.4% of total costs.

Other costs totalled $2.9 million or 1.2% in 2016/17. The majority of these costs are related to benefit claims processing through the HICPS system.

Figure 5.1: Distribution of NIHB Dental Expenditures ($ Millions) 2016/17

Source: FIRMS adapted by Business Support, Audit and Negotiations Division

Text Equivalent

| Million $ | Proportion | |

|---|---|---|

| Fee-For-Service (HICPS) | $212.2 | 90.0% |

| Contribution Agreements | $12.6 | 5.3% |

| Other Costs | $2.9 | 1.2% |

| Contract Dentists | $8.1 | 3.4% |

| Total NIHB Dental Expenditures | $235.8 | 100.0% |

Figure 5.2: Total NIHB Dental Expenditures by Type and Region ($ 000's)

2016/17

NIHB Dental expenditures totalled $235.8 million in 2016/17. The regions of Ontario (22.1%), Saskatchewan (20.1%), Alberta (18.8%) and Manitoba (17.0%) had the largest proportion of overall dental costs. The Ontario Region had the highest total dental expenditure at $52.1 million and the Atlantic Region had the lowest total dental expenditure at $9.6 million.

| Region | Operating | Total Operating Costs | Total Contribution Costs | Total Costs | ||

|---|---|---|---|---|---|---|

| Fee-For-Service | Contract Dentists | Other Costs | ||||

| Atlantic | $9,593 | $0 | $0 | $9,593 | - | $9,593 |

| Quebec | $17,456 | $0 | $0 | $17,456 | $113 | $17,569 |

| Ontario | $43,094 | $2,614 | $46 | $45,754 | $6,350 | $52,105 |

| Manitoba | $34,887 | $5,046 | $0 | $39,933 | $53 | $39,986 |

| Saskatchewan | $43,727 | $0 | $0 | $43,727 | $3,593 | $47,321 |

| Alberta | $41,983 | $41 | $0 | $42,025 | $2,290 | $44,315 |

| North | $21,406 | $353 | $0 | $21,759 | $207 | $21,966 |

| Headquarters | - | - | $2,877 | $2,877 | - | $2,877 |

| Total | $212,248 | $8,055 | $2,923 | $223,226 | $12,605 | $235,831 |

| Source: FIRMS adapted by Business Support, Audit and Negotiations Division | ||||||

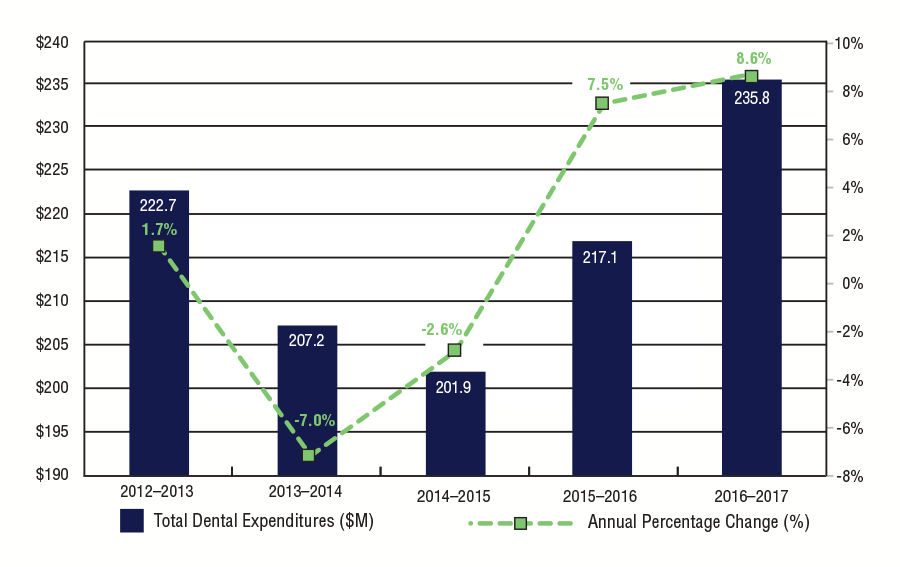

Figure 5.3: Annual NIHB Dental Expenditures

2012/13 to 2016/17

NIHB Dental expenditures increased by 8.6% during fiscal year 2016/17. The decrease in overall NIHB Dental expenditures recorded in fiscal years 2013/14 and 2014/15 can be attributed to the transfer of eligible First Nation clients residing in British Columbia to the First Nations Health Authority (FNHA). If expenditures for FNHA eligible clients are excluded from 2012/13 and 2013/14 total NIHB expenditures, then the dental expenditure growth rate for 2013/14 would have been 3.8%.

Over the last five years, annual growth rates for NIHB Dental expenditures have ranged from a high of 8.6% in 2016/17 to a low of -7.0% in 2013/14.

Figure 5.3.1: NIHB Dental Expenditures and Annual Percentage Change

Source: NIHB Dental Expenditures and Annual Percentage Change

Text Equivalent

| Year | Total Dental Expenditures ($M) | Annual Percentage Change (%) |

|---|---|---|

| 2012/13 | $222.7 | 1.7% |

| 2013/14 | $207.2 | -7.0% |

| 2014/15 | $201.9 | -2.6% |

| 2015/16 | $217.1 | 7.5% |

| 2016/17 | $235.8 | 8.6% |

| Region | 2012/13 | 2013/14 | 2014/15 | 2015/16 | 2016/17 |

|---|---|---|---|---|---|

| Atlantic | $9,660 | $8,609 | $8,238 | $8,846 | $9,593 |

| Quebec | $15,239 | $15,216 | $15,799 | $16,641 | $17,569 |

| Ontario | $42,259 | $43,972 | $46,759 | $49,903 | $52,105 |

| Manitoba | $30,734 | $33,649 | $33,527 | $36,764 | $39,986 |

| Saskatchewan | $36,219 | $36,399 | $37,679 | $41,028 | $47,321 |

| Alberta | $34,501 | $34,928 | $35,974 | $39,753 | $44,315 |

| North | $19,773 | $20,415 | $20,413 | $20,936 | $21,966 |

| Headquarters | $2,779 | $2,978 | $2,943 | $2,920 | $2,877 |

| Total | $222,706 | $207,179 | $201,886 | $217,109 | $235,831 |

| Source: FIRMS adapted by Business Support, Audit and Negotiations Division | |||||

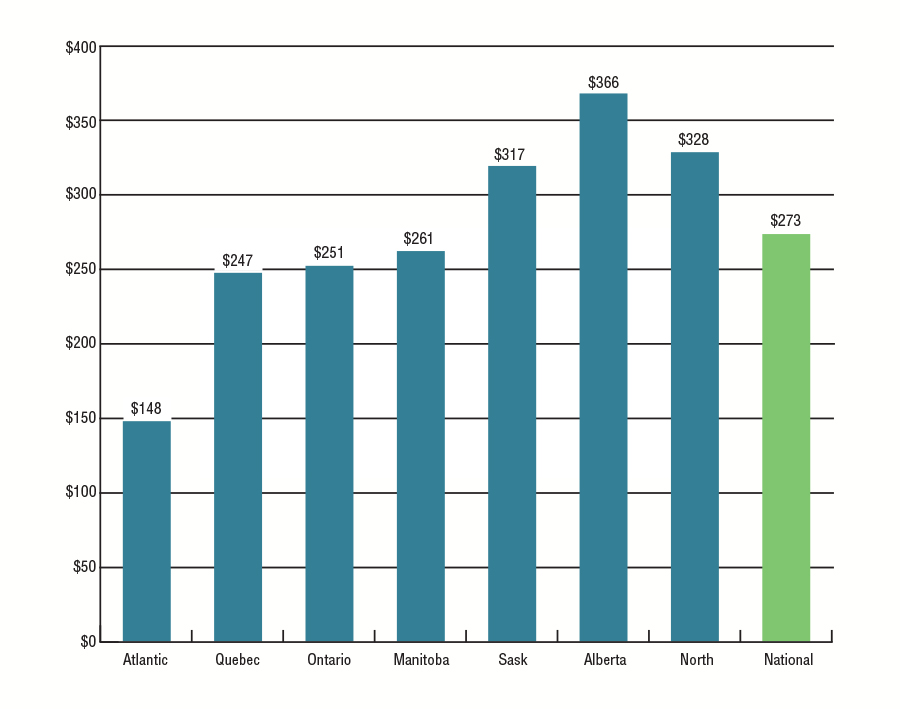

Figure 5.4: Per Capita NIHB Dental Expenditures by Region

2016/17

In 2016/17, the national per capita NIHB Dental expenditure was $273, an increase of 7.0% from $255 recorded in 2015/16.

The Alberta Region had the highest per capita dental expenditure at $366, followed closely by the Northern Region at $328 and Saskatchewan Region at $317. The Atlantic Region had the lowest per capita dental cost at $148 per eligible client. The lower per capita cost in the Atlantic Region can be partly attributed to an increase in the eligible client population in this region as a result of the registration of 24,745 Qalipu Mi'kmaq First Nations clients. A large number of these clients have alternative dental coverage, so the lower level of dental benefit utilization for these new clients has impacted the dental per capita cost for the Atlantic Region as a whole.

Per capita values reflect NIHB Dental expenditures only, and do not include additional dental services that may be provided to First Nations and Inuit populations through other Department of Indigenous Services Canada programs or through transfers and other arrangements.

Figure 5.4: Per Capita NIHB Dental Expenditures by Region 2016/17

Source: SVS and FIRMS adapted by Business Support, Audit and Negotiations Division

Text Equivalent

| Region | Per Capita Expenditures |

|---|---|

| Atlantic | $148 |

| Quebec | $247 |

| Ontario | $251 |

| Manitoba | $261 |

| Saskatchewan | $317 |

| Alberta | $366 |

| North | $328 |

| National | $273 |

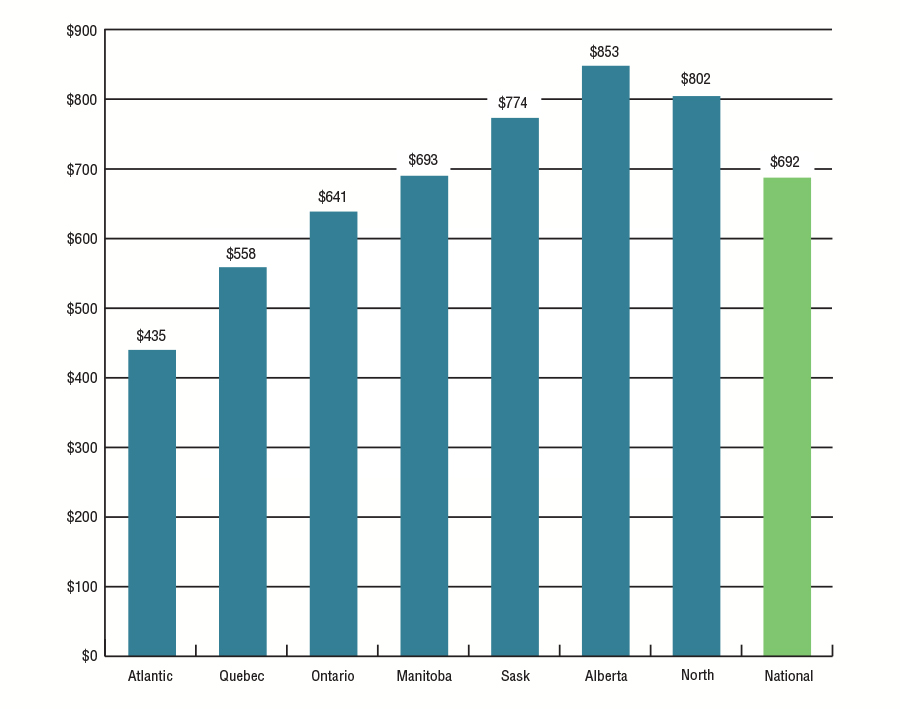

Figure 5.5: NIHB Dental Fee-For-Service Expenditures per Claimant by Region

2016/17

In 2016/17, the national NIHB Dental expenditure per claimant (i.e. eligible clients who received at least one dental benefit) was $692. This represents an increase of 6.2% over the $652 recorded in 2015/16.

The Alberta Region had the highest dental expenditure per claimant at $853 followed by the Northern Region at $802, an increase of 7.4% and 4.6% respectively from $794 and $767 in the previous year.

Figure 5.5: NIHB Dental Fee-For-Service Expenditures per Claimant by Region 2016/17

Source: FIRMS and HICPS adapted by Business Support, Audit and Negotiations Division

Text Equivalent

| Region | Per Claimant |

|---|---|

| Atlantic | $435 |

| Quebec | $558 |

| Ontario | $641 |

| Manitoba | $693 |

| Saskatchewan | $774 |

| Alberta | $853 |

| North | $802 |

| National | $692 |

Figure 5.6: NIHB Dental Utilization Rates by Region

2012/13 to 2016/17

Utilization rates reflect the number of clients who, during the fiscal year, received at least one dental service paid through the HICPS system as a proportion of the total number of eligible clients.

In 2016/17, the national utilization rate for dental benefits paid through the HICPS system was 36%, consistent with the previous four fiscal years. National NIHB Dental utilization rates have remained stable over the past five years.

Dental utilization rates vary across the regions with the highest dental utilization rate found in the Quebec Region (44%). The lowest dental utilization rate was in the Ontario Region (32%). It should be noted that the dental utilization rates understate the actual level of service, as this data does not include:

- Department of Indigenous Services Canada dental clinics (except in the Yukon);

- Contract dental services provided in some regions;

- Services provided by Department of Indigenous Services Canada Dental Therapists or other FNIHB dental programs such as the Children's Oral Health Initiative (COHI); and

- Dental services provided through contribution agreements. For example, HICPS data does not capture any services utilized by the Bigstone Cree Nation. If this client population was removed from the Alberta Region's population, the utilization rate for dental benefits for Alberta would have been 43% in 2016/17. The same scenario would apply for the Ontario Region. If the Akwesasne client population in Ontario were to be removed, the utilization rate for dental benefits in Ontario would have been 35%. If both the Bigstone and Akwesasne client populations were removed from the overall NIHB population, the national utilization rate for dental benefits would have been 37%.

Over the two year period between 2015/16 and 2016/17, 412,479 distinct clients received NIHB Dental services resulting in an overall 48% utilization rate over this period.

| Region | Dental Utilization | NIHB Dental Utilization Last Two Years 2015/17 | ||||

|---|---|---|---|---|---|---|

| 2012/13 | 2013/14 | 2014/15 | 2015/16 | 2016/17 | ||

| Atlantic | 34% | 34% | 33% | 34% | 34% | 44% |

| Quebec | 44% | 45% | 45% | 45% | 44% | 56% |

| Ontario | 32% | 32% | 32% | 32% | 32% | 42% |

| Manitoba | 31% | 32% | 32% | 32% | 33% | 46% |

| Saskatchewan | 36% | 36% | 36% | 36% | 38% | 53% |

| Alberta | 39% | 41% | 39% | 40% | 41% | 55% |

| Yukon | 37% | 39% | 37% | 36% | 36% | 50% |

| N.W.T. | 41% | 43% | 41% | 40% | 41% | 55% |

| Nunavut | 42% | 43% | 42% | 40% | 38% | 55% |

| National | 36% | 36% | 35% | 35% | 36% | 48% |

| Source: HICPS and SVS adapted by Business Support, Audit and Negotiations Division | ||||||

Figure 5.7: NIHB Dental Claimants by Age Group, Gender and Region

2016/17

Of the 853,088 clients eligible to receive dental benefits through the NIHB Program, 306,705 (36%) claimants received at least one dental procedure paid through the HICPS system in 2016/17.

Of this total, 171,841 were female (56%) and 134,864 were male (44%), compared to the total eligible NIHB population where 51% were female and 49% were male.

The average age of dental claimants was 31 years, indicating clients tend to access dental services at a slightly younger age compared to pharmacy services (35 years of age). The average age for female and male claimants was 32 and 30 years of age respectively.

Approximately 37% of all dental claimants were under 20 years of age. Forty percent of male claimants were in this age group compared to 34% of female claimants. Approximately 5% of all claimants were seniors (ages 65 and over) in 2016/17.

| Region | Atlantic | Quebec | Ontario | Manitoba | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|